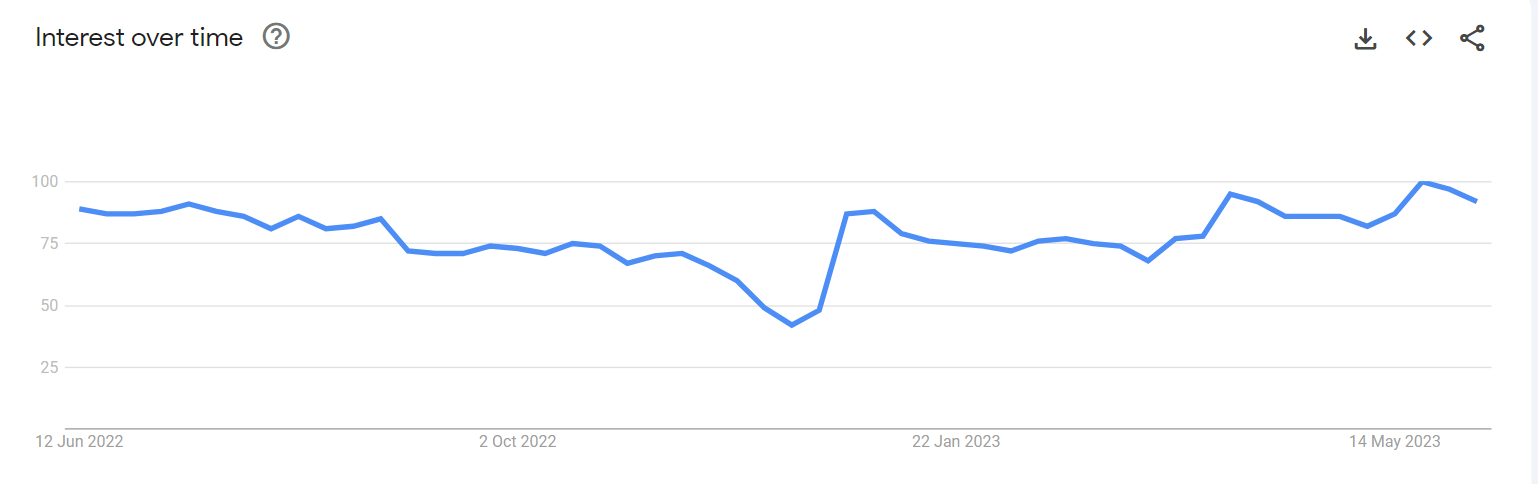

With Google search results for ‘furniture’ significantly increasing around this time of year, retailers must be prepared for any influx in demand and the logistical challenges that come with it, particularly throughout the last-mile.

UK searches of ‘furniture’ during April were largely driven by garden and outdoor furnishings, as consumers look to equip themselves for the warmer months ahead.

According to Google search data analysed by Big Furniture Group, five days during April 2023 saw ‘furniture’ searches record an index score of 90 or more (out of 100), while 10 days recorded an index score over 80. Easter weekend saw the highest number of searches during the month, scoring over 90, with Easter Monday (10th April) reaching the peak at 100.

For clarity this search data reflects an unfiltered sample of search requests made to Google Search and displays interest or popularity in a particular topic from around the world and specific locations. The index score is gauged out of 100, with this being the highest amount of search interest a specific term can achieve.

A similar peak in search activity was seen the following month in May, suggesting that consumers are showing interest and possible buyer intent for furniture in the UK.

Over the same period related searches of ‘garden furniture’ were equally popular – searches for ‘Tesco garden furniture’ increased by 250%, followed by ‘Laura James garden furniture’, which increased by 200%.

Other brands which saw a significant spike included: Homesense, B&M, The Range, M&S, ASDA, Habitat and IKEA.

As for product related searches, brown rattan garden furniture searches rose 180%, while egg chair searches increased by 160%, making them two of the most popular searches for specific furniture products.

Based on historical search data this uptick in search activity for furniture continues throughout the summer until the beginning of spring, where search data starts to decline as cooler temperatures become prevalent and consequent interest in outdoor furniture wanes.

Search activity then picks up once again during peak season, more specifically from November onwards, as consumers make use of promotional sales associated with it such as Black Friday.

Research suggests that furniture retailers may not be prepared to deliver for their customers this summer however, nor beyond during peak season, as they’ve not yet mastered the logistics of last-mile delivery and the common key challenges it presents.

Last year furniture businesses lost 61% of their customers for failing to deliver on time

The importance of the last-mile of logistics cannot be overstated, as it is typically the final touchpoint between retailers and their customers. Outside of the product itself, it is an opportunity for retailers of all industries to leave a lasting impression that builds customer loyalty and a positive brand reputation.

Increasingly, customers’ expectations surrounding last-mile delivery have changed dramatically over recent years, particularly since the delivery boom the COVID-19 pandemic created.

Since the pandemic, newfound expectations have become the status quo, and customers expect the level of service they received throughout the pandemic as standard, regardless of who they are ordering from.

One such newfound expectation has been reflected in the research, which suggests that consumers want full transparency and visibility over their delivery now more than ever.

Nine in ten consumers surveyed in the study want the ability to track their order. While 41% want to know exactly where their order is in real-time and 50% want a general idea.

Real-time order and delivery tracking is of particular interest to consumers within the furniture industry, as often they will have to grant the courier access to their premises, and may have preferences as to where they would like their newly purchased furniture placed.

It is an industry where delivery day feels much more bespoke and real-time access to driver locations to ensure successful delivery is becoming increasingly necessary.

Despite this, one in three consumers were not able to track their most recent delivery, and 37% were able to track their most recent delivery but couldn’t see the delivery driver’s location throughout the last-mile, which is detrimental to the customer’s experience.

It is unsurprising that those surveyed in the study had experienced a high percentage of rescheduled deliveries, as there were evident issues pertaining to the lack of visibility over their order.

58% of deliveries that were categorised as ‘big and bulky’ were rescheduled, which fits into the description of most furniture products – of those 47% were rescheduled once, 32% twice, 15% three times, and 6% four times or more.

Furniture retailers having to reschedule the majority of their deliveries is of major concern, as the cost of failed deliveries is stark, not only for a company’s reputation, but also for their profit margins.

Not to mention the additional logistical headaches it creates having to re-plan deliveries and the impact this has on the environment.

Estimates believe that it costs retailers £11.60 per failed delivery, meaning that many businesses often end up losing money on re-delivering orders with small profit margins.

There are often more complexities and challenges associated with the last-mile of delivery when large items are involved, particularly when it comes to furniture, that’s why it is essential that retailers offer (and delivery within) clear delivery windows, real-time tracking and proactive updates that keep the customer informed and engaged throughout.

Failure to do so means retailers run the risk of losing customers due to deliveries being late or failed – six in ten consumers (61%) are unlikely to purchase from a retailer again when a previous order misses the scheduled delivery window.

Such issues are avoidable with the right Transport Management Software in place to better manage deliveries and master the last-mile.

Half of consumers blame negative delivery experiences on bad communication

Communication will always be key throughout the entirety of a consumer’s lifecycle, especially when it comes to the last-mile. It should be viewed as an opportunity for retailers to offer their customers a flawless experience that, in turn, helps retailers to gain market share.

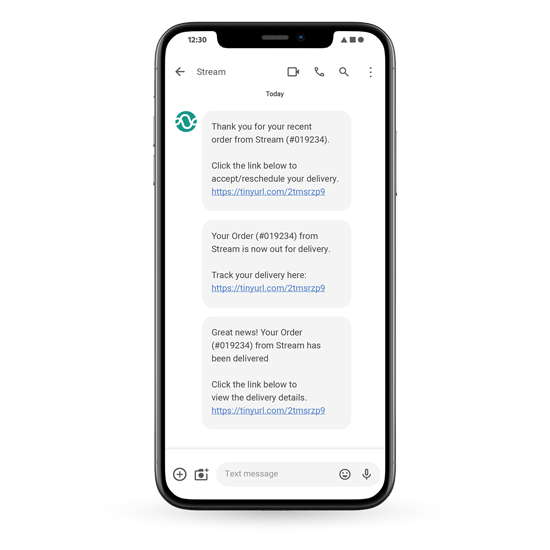

Consumers expect frequent order status updates, and they expect to receive them where they are most likely to be seen – via text message, Whatsapp or email. These channels should be prioritised and utilised as standard for any retailer that delivers products to their customers.

The overwhelming majority (80%) of the participants in the survey said that they want to receive delivery status updates. 27% want updates as often as possible even if that means multiple times a day, while 39% want daily updates.

Customers also favour receiving status updates via text (70%) too, more so than email (50%) and calls (38%). These findings corroborate with other studies that have evaluated which channels are most effective for receiving delivery updates.

Research has also shown that SMS text messaging channels are checked more frequently than any other mode of communication – 1 in 3 consumers check their SMS text notifications within one minute of receiving a text, and 53% of consumers check their text messages at least 11 times a day.

On the basis of this data, sending SMS delivery updates is an effective way to keep customers informed and engaged throughout the delivery process – ultimately reducing the likelihood of missed deliveries, saving time as well as money.

For furniture retailers that currently don’t offer updates via SMS, it’s worth considering given how cheap and effective they really are, and it’s recommended that they are used to supplement email notifications, not replace them.

Conclusion

The data from the study suggests that consumers are unforgiving when it comes to negative experiences during the last-mile of delivery, as reflected by the reality that six in ten consumers (61%) are unlikely to purchase from a retailer again when a previous order misses the scheduled delivery window.

Retail customers, particularly within the furniture industry, want to know the precise location of their order throughout its journey, as well as exact delivery times (to such an extent that early delivery is viewed as a hindrance). This is unsurprising given the nature of furniture deliveries, which should feel like bespoke experiences that are tailored to the needs of the customer and their time preferences.

By offering real-time delivery tracking in conjunction with proactive SMS delivery updates, retailers that deliver goods in their own vehicles can communicate delivery information as effectively as possible, and better position themselves to cope with the logistical pressures that come with any influx in demand. Creating a frictionless last-mile experience for customers will help them to build customer loyalty, cut cost and increase their overall market share.

For a more in-depth look at delivery tracking in the furniture industry, we suggest reading our insightful ‘Delivery Tracking System: Where is My Garden Furniture’ piece.