Which well-known Home & Garden brands are excelling at ecommerce (and delivery) in 2022?

Avalara and Fluid Commerce’s Home & Garden Top 50: Ecommerce Report has analysed the leading Home & Garden ecommerce retailers whose websites are built on Adobe Commerce (and powered by Magento) in order to identify which well-known brands are excelling at ecommerce, and which are at risk of falling behind.

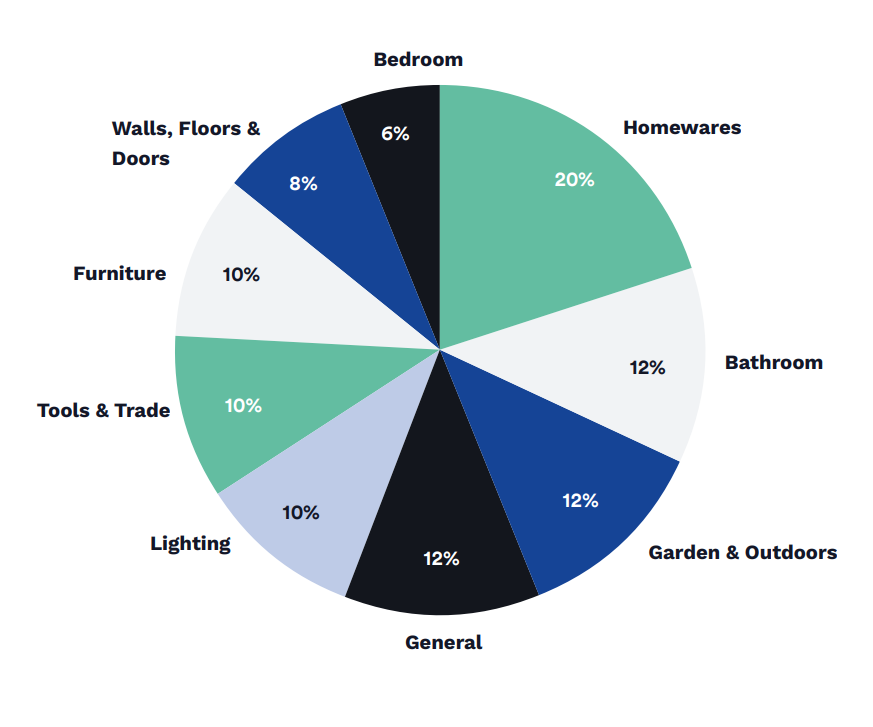

The Adobe Commerce merchants were selected to ‘ensure a fair, diverse and accurate representation of the Home & Garden sector in the UK’, and includes brands from within the Home & Garden sub-sectors; including lighting, furniture and bathroom, and a mixture of ‘mid-scale and well-known retailers to ensure a clear picture of the industry’.

Chart by Fluid Commerce

The research was conducted in March 2022, and examined how the selected Home & Garden merchants performed in eight categories: speed, trust, navigation, mobile UX, product page, payment & checkout, delivery & returns and community.

The primary aim of this report is to analyse the current state of the retailer’s ecommerce platforms and identify key trends that other retailers can benchmark against.

The secondary aim of this report is to provide examples of ‘ecommerce best practice’ by ‘showcasing the brands that are performing at the top of their game’, thus illustrating how and why certain retailers excelled in each of the eight respective categories.

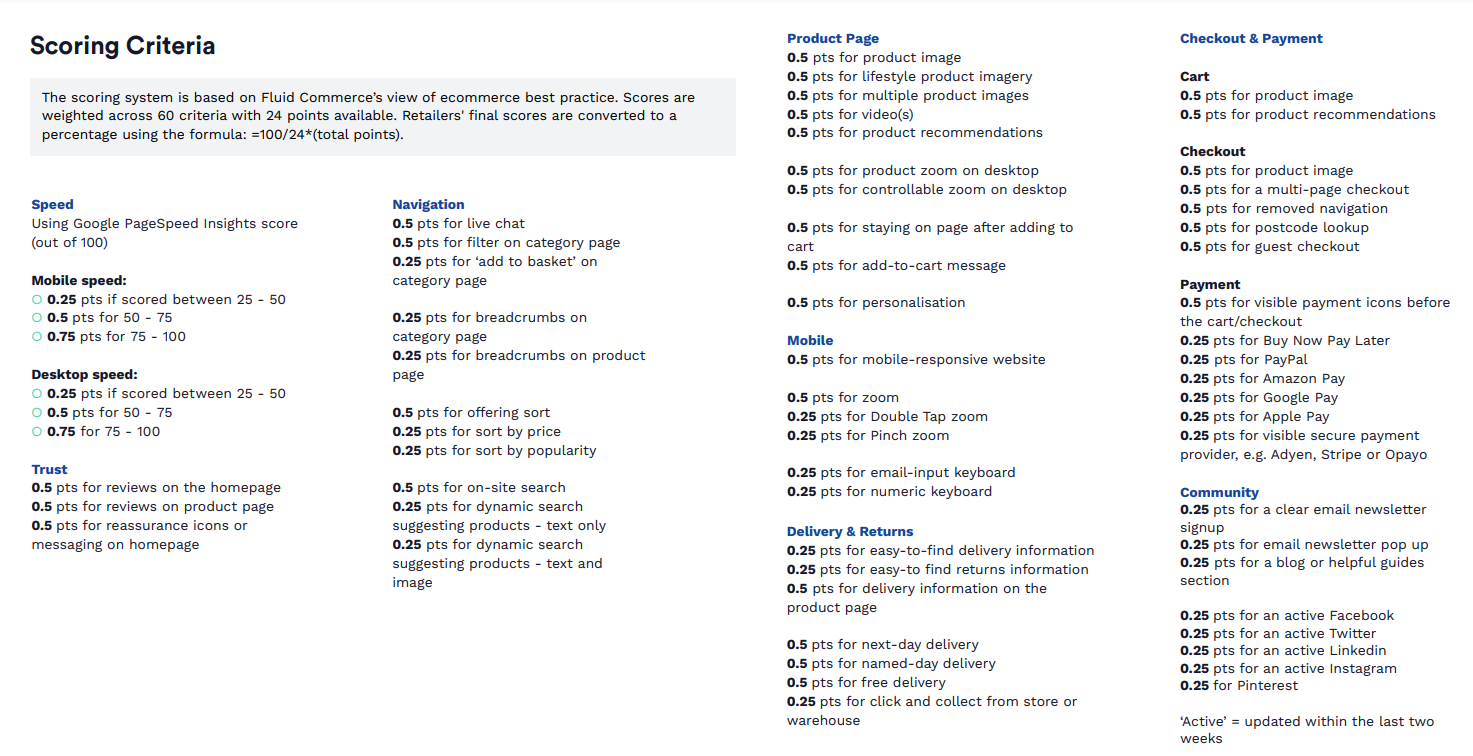

Scoring Criteria

The scoring system is based on Fluid Commerce’s view of ‘ecommerce best practice’.

Scores are weighted across 60 criteria, spread across the eight aforementioned categories, with a total of 24 points available. Retailers’ final scores are converted to a percentage using the formula: =100/24*(total points) and ranked accordingly.

The findings of the study were then compared to Fluid Commerce’s 2021 Home & Garden Top 60 Ecommerce Report to gauge how, and by how much, the retailers had improved their online stores.

This creates an accurate year-on-year view that identifies whether or not retailers are investing time and money into improving upon their ecommerce experience for their customers.

Two retailers in particular, Primrose and Bradfords Building Supplies, demonstrated a significant percentage improvement in comparison to their 2021 score.

In a drastic u-turn, the retailers progressed from the bottom of Fluid Commerce’s 2021 report, to this year’s top 10.

Primrose saw a 22% increase in their score, progressing from 56% in 2021 to 78% in 2022, thanks to improvements which included increasing the site speed, introducing Live Chat, overhauling the checkout process and adding Klarna and Paypal as payment options

Bradfords Building Supplies also saw a 22% increase from 55% in 2021 to 77% in 2022. Their onsite improvements included introducing dynamic site search, adding an email pop up, offering more delivery options, overhauling the checkout process and introducing a BNPL option.

Both retailers made simple onsite changes that drastically enhanced the user’s experience, and showed that they were evolving in line with consumer expectations and trends by offering new features such as BNPL options.

Retailers were marked under eight categories and supported by best in class examples

-

Speed

The study measured retailers’ site speed using Google PageSpeed Insights to gauge how responsive their store was on mobile and desktop. Slow and unresponsive websites can deter shoppers and increase the bounce rate.

In general, Home & Garden retailers performed well for speed on desktop but mobile was a struggle for most.

The average score for desktop was 59 and the average score for mobile speed was 25, with Pimpernel being the fastest overall, with a near perfect score of 96 on desktop and an impressive mobile score of 62.

-

Trust

The study looked at trust signals, such as reviews, awards, finance options or money-back guarantees. These instil confidence in the brand, and can convert shoppers from a casual browser into an active buyer.

Over half (54%) won the maximum amount of points by including reassurance icons or messaging on the home page, plus reviews on their homepages and product pages.

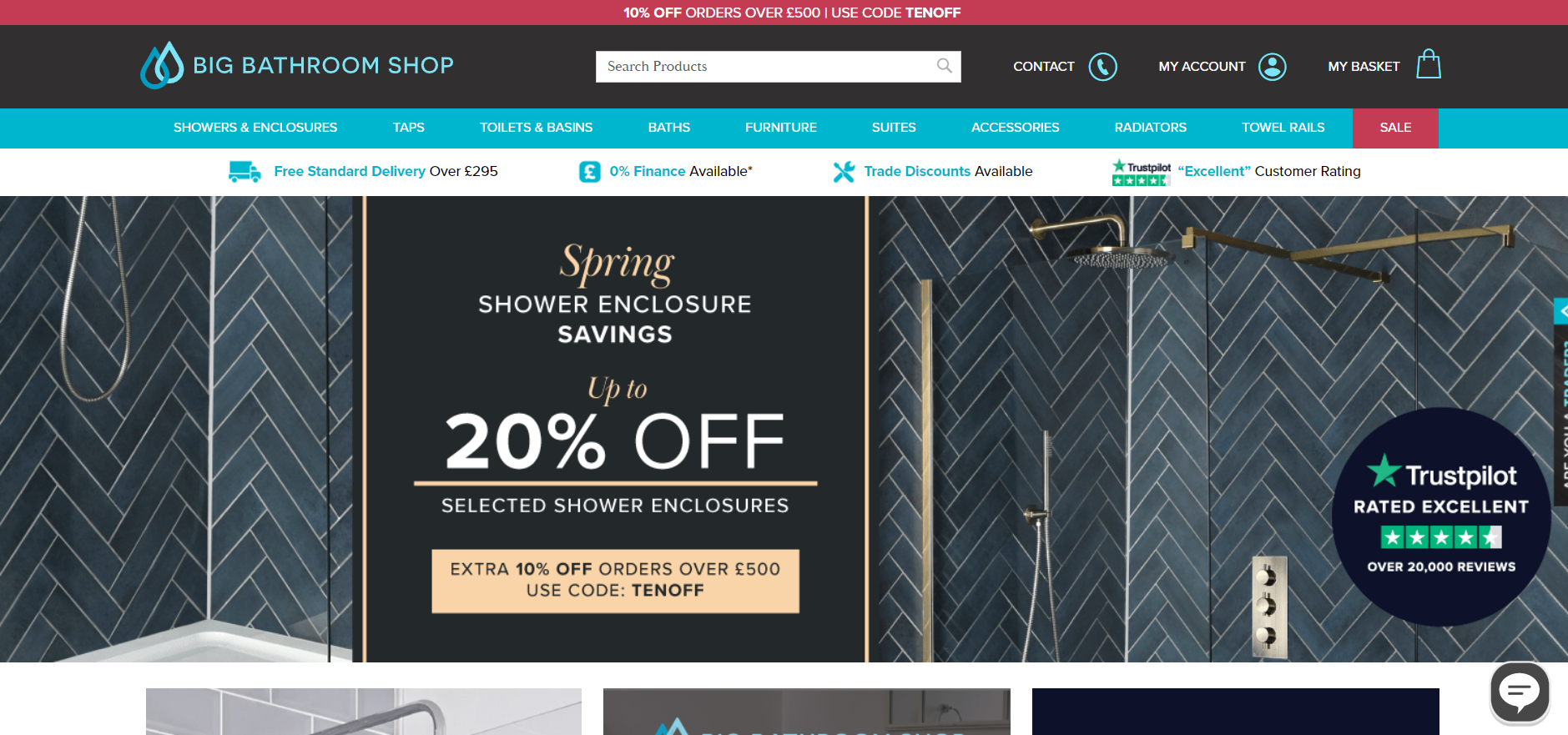

Big Bathroom Shop excelled in this category. It showcases its 0% Finance offer, Klarna integration, trade discounts and free delivery option. It also exhibits its ‘Excellent’ reviews on its home page and product pages

-

Navigation

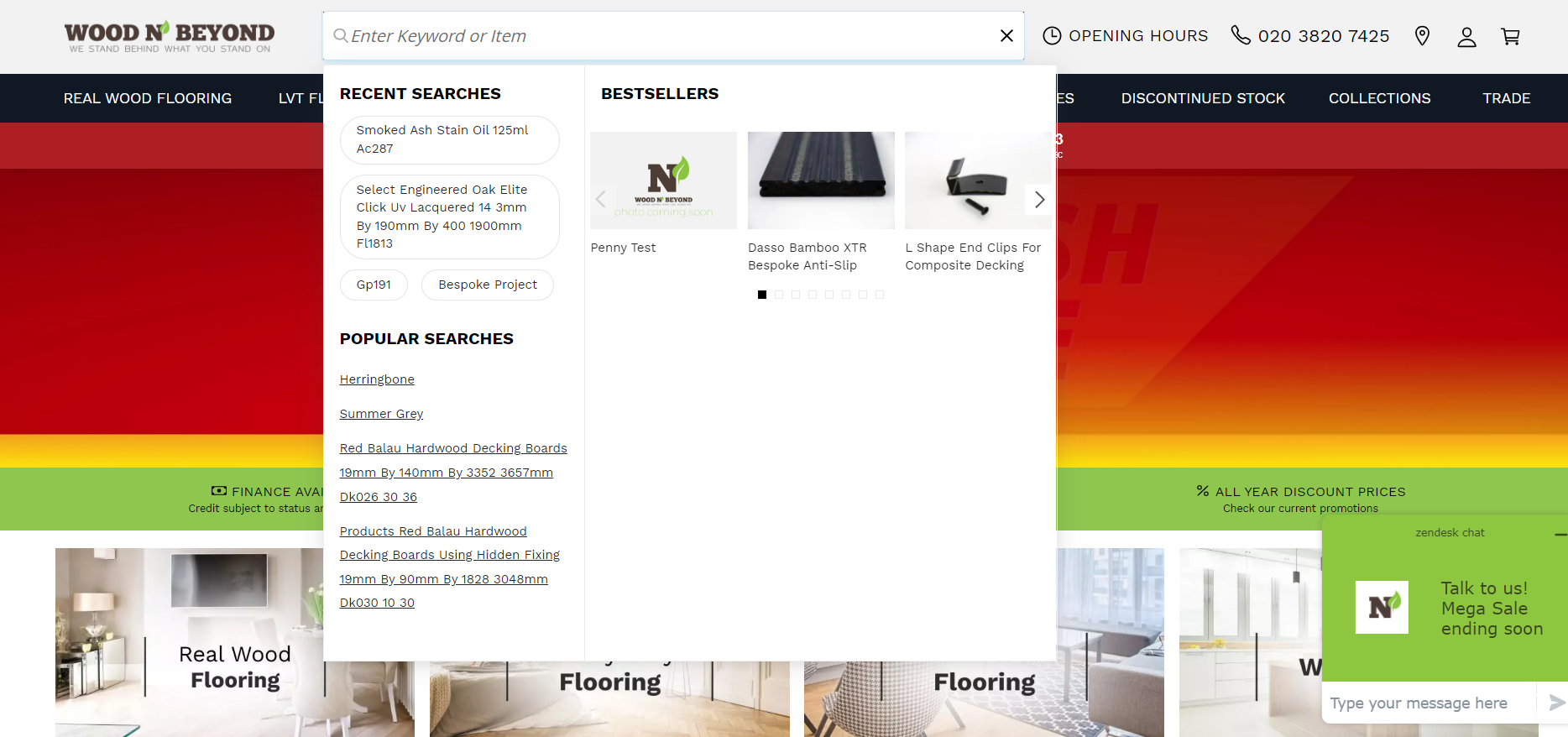

Functionalities such as breadcrumbs, filters, sorting functions, search and live chat were looked at, which merchants can utilise to help the user navigate around a website easily and find what they’re looking for quickly.

Simple and intuitive navigation plays a key role in building customer loyalty, increasing conversion rates and reducing bounce rates. Customers should be able to seamlessly navigate through a website in a simple and intuitive fashion.

Despite this, only two merchants got full marks for navigation: Wood and Beyond and Charles Bentley.

Wood and Beyond has a useful site search – showing products, popular searches, category pages, and customer service pages.

-

Mobile User Experience (UX)

Features including product image zoom options, input-specific email keyboards and input-specific number keyboards were analysed in order to see how fast and intuitive the mobile shopping experience was for the consumer.

18% of the brands scored top marks for this category, with Soak&Sleep being the standout since it offers a number and email-input specific keyboard – perfect for a fast checkout. It is also fully mobile responsive, with both pinch and double-tap zoom available on product images.

-

Product Page

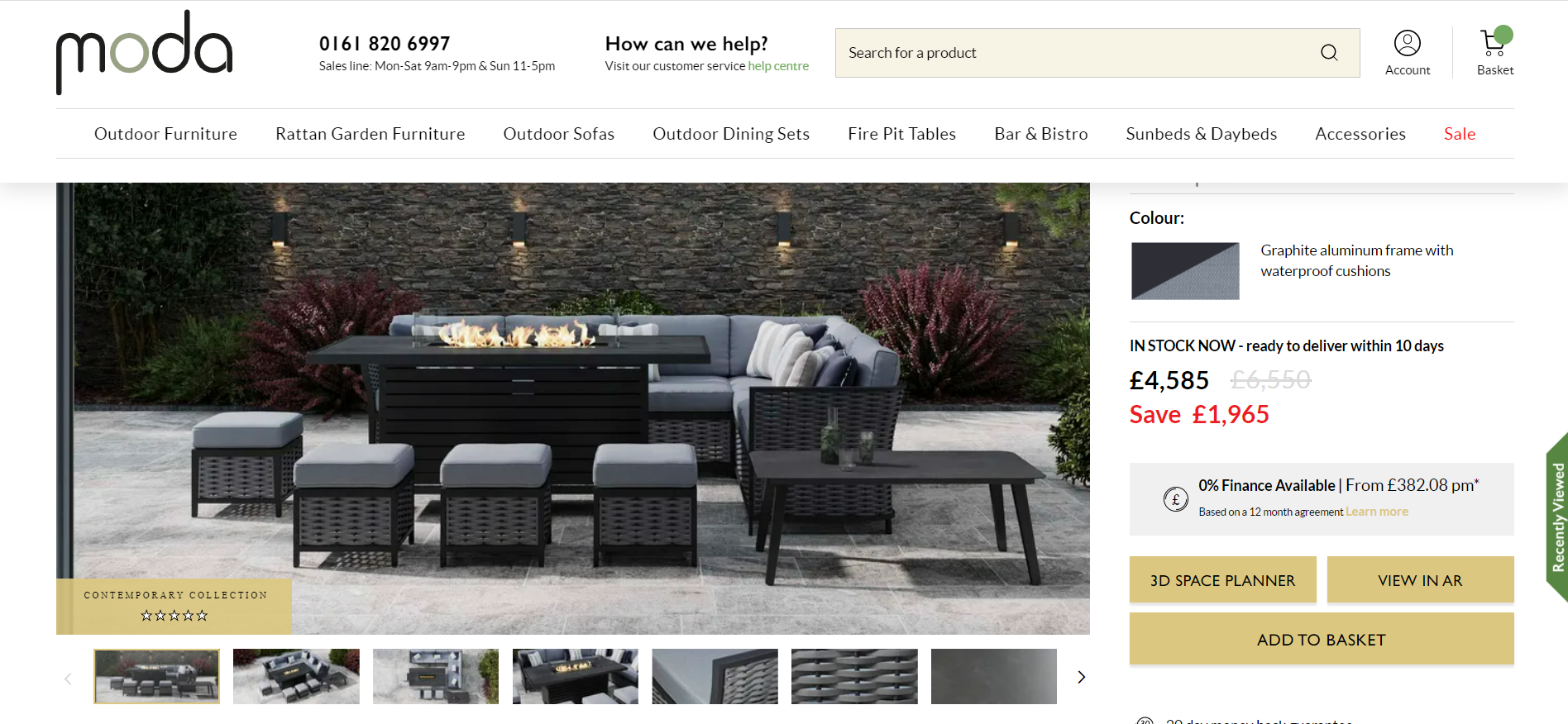

The study posed a few questions for this category. Were the shoppers able to visualise what the product would look like in their home or garden? Did the retailers offer product recommendations? Were they personalised by solutions such as Nosto or Clerks.io?

Moda Furnishings scored top marks by offering a plethora of product videos and images, an impressive 3D planner and even an augmented reality tool. It also included product info, delivery info, reviews, and a ‘Recommended Products’ carousel in a clear fashion.

-

Payment & Checkout

This category assessed how streamlined, distraction-free, secure and fast the retailers’ checkout and payment processes were, reducing the likelihood of an abandoned cart.

86% of the retailers included visible signposting of payment options in the global footer, homepage or product page.

Many lost points by not offering a sufficient range of payment options that speed up and simplify the checkout process. These include Buy-Now-Pay-Later (BNPL) options such as Klarna or Clearpay, as well as Amazon Pay, Google Pay and Apple Pay.

Iconic Lights offered a payment and checkout masterclass by including a large range of payment options, thoughtful add-ons and recommended products in the basket, plus a multi-page checkout with removed navigation.

-

Delivery & Returns

Being transparent and effectively communicating delivery and return policies are essential for any ecommerce brand to build customer loyalty.

The study analysed whether or not the retailers had a dedicated delivery and returns page, and if they displayed delivery information on the product page.

Brands were also scored on their delivery options, including free delivery, next day delivery, named day delivery and click & collect.

Home & Garden merchants were very transparent and provided clear communication.

- 100% of the retailers in the study had a dedicated delivery page

- 92% had a dedicated returns page

- 82% displayed delivery information on the product page

- Free delivery was the most widely-offered option (72%)

French Bedroom Company was exemplary in this category. Their website included clearly displayed delivery information on the product page with a countdown for next day delivery. It also offered a white glove delivery service, free delivery, nominated-day delivery and collection from the store.

-

Community

In the ‘community’ category, brands were assessed on how they build and maintain an engaged community of customers through social media as well as email marketing.

Here they scored brands on the number of social channels they utilised and whether or not they included clear newsletter sign up forms, and pop-up email forms.

Most retailers performed well on social media, with Facebook and Instagram proving to be the two most popular channels, closely followed by Pinterest.

Email was also popular, with 90% displaying a clear sign up form, however, only half (50%) used a pop up, asking shoppers to subscribe (usually in exchange for a discount code).

Cox & Cox used a pop up to encourage newsletter subscribers. Its social media channels were adjudged to be regularly updated with content tailored to the specific channel. It also provided an inspirational blog for shoppers to keep them further informed and engaged.

Benchmarking

The average score for all Home & Garden retailers featured in the report is 70%.

When broken down into sub-sectors, Bedroom and Homewares retailers were among the highest scorers:

- 73% – Bedroom

- 72% – Homewares

- 71% – Lighting

- 71% – Garden & Outdoors

- 70% – Tools & Trade

- 69% – General

- 68% – Walls, Floors & Doors

- 67% – Bathroom

- 65% – Furniture

The Top 10 retailers:

- 81% – Soak&Sleep

- 80% – Iconic Lights

- 80% – Big Bathroom Shop

- 79% – The Paint Shed

- 78% – Primrose

- 78% – French Bedroom

- 77% – Moda

- 77% – Linens Limited

- 77% – Tile Giant

- 77% – Rockett St George

Conclusion

The findings of the study demonstrated that the majority of the Top 50 retailers (27/41) had improved upon their score from Fluid Commerce’s corresponding 2021 study. As nine were new entries they’ve been omitted from this comparison. Thirteen retailers scored worse in comparison, and only one achieved the same score.

This is wholly positive as it shows that the retailers are investing both time and money into improving their online shopping experiences. It also suggests that these retailers are keeping up to date with consumer trends, particularly BNPL options like Klarna and Clearpay.

The top percentage score being 81%, and the average score among the Top 50 being 71%, shows that there’s still room for improvement, and that retailers can and should be doing more to offer their customers a flawless user experience that meets Fluid Commerce’s criteria for ‘ecommerce best practice’.

Click here to download Avalara and Fluid Commerce’s Home & Garden Top 50: Ecommerce Report

Interested in reading more about customer service and your delivery / logistics experience?

Delivering an exceptional customer service is a subject very dear to our hearts and has been at the very centre of how and why the software was designed and built in the first place.

These blog articles might prove useful if your doing more research:

How luxury brands can use a premium delivery service to create in-boutique experiences can be used for any retail brand – luxury or not.

Trends within the transport and logistics industry that you should be aware of.

How text and email delivery notifications could be the secret to happy customers.