Over the past two years, three key trends: eGrocery, micro-fulfilment centres and automation, have precipitated unparalleled growth and change within intralogistics.

Logistics processes for micro-fulfilment for groceries in particular have witnessed significant innovation over that time period to such an extent that customers in major cities across the globe can have their food shopping delivered to their homes in under 10-minutes; catering for shifting consumer expectations which have been formed as a result of the Covid-19 pandemic.

This has resulted in the emergence of powerhouse eGrocery delivery brands with multi-billion pound valuations, such as Getir and Gorillas, while the likes of fast food delivery services Just Eat, Deliveroo and Uber Eats have also expanded into the grocery delivery market.

On demand grocery delivery brands like Getir and Gorillas in particular have mastered intralogistics to such an extent that they can offer unparalleled delivery times (often under that 10-minute ‘target’).

The efficiency and forward-thinking nature of their intralogistics enables them to offer a seamless customer experience, which differentiates them in the eGrocery marketplace and allows them to boast marketing taglines such as ‘groceries at your door in minutes.’

Element Logic’s whitepaper offers insight into how the aforementioned three key trends are shaping the future of intralogistics, and how fast emerging unicorn companies have utilised them to establish themselves as market leaders with over £1bn valuations.

What is intralogistics?

In its simplest of terms, Intralogistics refers to the ‘management and optimization of internal production and distribution processes.’

Through the successful implementation of new methods of connection and interaction, intralogistics allows information and physical goods to flow as effectively as possible.

Covid-19 precipitates intralogistics

The Covid-19 pandemic permanently altered consumer behaviour and created the conditions for shorter lead times and immediacy, as focus shifted towards stay-at-home deliveries.

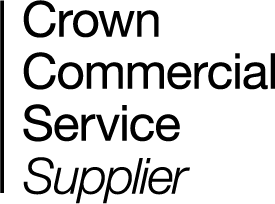

Grocery is the sector where last-mile fulfilment gained the most traction due to the Covid-19 pandemic. There has been a 180% increase in online grocery demand in the UK since the onset of Covid-19 in early 2020 and online sales now account for 15% of the market’s total sales, and this percentage is expected to continue to increase year-on-year.

To the delight of eGrocery stores in particular, the online food & grocery market rose 76.3% in 2020 to over £20bn in spend for the year. 48.7% of food & grocery shoppers in the UK purchased grocery items online, up from 47.4% in 2019 – an increase that equates to an extra 985,000 shoppers over a year period.

Despite this exponential surge in demand for food and groceries online, the industry’s logistics networks were able to cope.

Operators responded impressively throughout 2020 by increasing home delivery capacity from 1.8 million deliveries per week to 3.7 million deliveries per week, driving five years of growth in online grocery sales within the first five months of the pandemic.

Ocado, for example, added additional delivery stop times to increase their offering capacity, which has become a permanent mainstay in the aftermath of the pandemic.

Supermarket chains are continuing to adapt and evolve their intralogistics in order to meet newfound consumer expectations that were formed as a by-product of the global pandemic.

In an interview with the Financial Times, Tim Steiner, chief executive and co-founder of Ocado, stated that the pandemic has changed the grocery market ‘for good’ worldwide, as well as the intralogistics of the market.

This change has been made evident by the fact that supermarket chains are now increasingly teaming up with delivery platforms to tap into the growing grocery delivery consumer market.

Co-op and Sainsbury’s have expanded their delivery offerings to UberEats and Deliveroo and Tesco have also partnered with Gorillas to offer a range of their products delivered in just 10 minutes.

Let’s take a deeper dive into each of those three trends: micro-fulfilment, automation and eGrocery.

Micro-fulfilment centres (MFCs)

“One industry that has embraced micro-fulfilment centres is the grocery market. Here, the consumers cannot wait for a long delivery time as they are buying essential items with expiration dates. With time I believe more sectors will follow” – Gavin Harrison, Sales Manager in Element Logic United Kingdom.

How do the likes of Getir and Gorillas offer almost instantaneous delivery which allow them to boast ‘groceries at your door in minutes’ marketing taglines?

The foundations of their intralogistics are built around the speed and efficiency of ‘dark stores’, which are defined as large retail facilities that resemble a conventional supermarket or other store but are not open to the public, housing goods used to fulfil orders placed online.

Dark stores are only accessible to staff and not the customer, essentially functioning for the purpose of delivery only. They are typically strategically placed in large cities which are usually only a maximum of two to three kilometres away from surrounding customers to ensure their goods reach the customer as quickly as possible.

These slightly differ to traditional micro-fulfilment centres which are regular storefronts that are open to the public and allow for in-store pickup, as well as delivery. The nuance here to traditional brick and mortar stores, however, is that they house their micro-fulfilment centre in the same building, typically at the back of the store.

Getir are currently experimenting with their intralogistics by trialling customer click and collect from several of its dark stores, in a bid to offer more options to their customers:

“Sometimes customers are really close to a Getir store, and going next door to pick something up might take the same time as ordering something and having a courier deliver it to you” – Getir Europe region general manager Turancan Salur.

Another evolution for eGrocery delivery services, particularly those who offer almost instantaneous delivery times, is to distribute profitably to smaller cities and rural areas, whilst retaining the speed and efficiency of their logistics and maintaining their under 10-minute delivery taglines.

This will most likely be achieved by micro-fulfilment centres that are combined with more extensive regional warehouses, and further investment in automated processes that can pick and sort the products faster than their human counterparts.

These seem logical areas of investment for rapid grocery delivery businesses, particularly as internal forecasts from Ocado have predicted a 30-40 per cent reduction in labour costs from greater automation once they have been fully implemented by 2024.

The likes of Getir and Gorillas are yet to implement advanced automation for the majority of their logistics processes, such as picking bots, and primarily rely on manual labour with lower productivity, which is further compounded by the limited spacing of their micro-fulfilment centres.

Track & trace technology powering micro-fulfilment centres

Traceability down to individual item level is fundamental to the success of a micro-fulfilment centre strategy in the eGrocery market – and many others.

Our CEO, Dave Pickburn explains how track and trace functionality can be used in Stream and and how it can benefit businesses adopting a MFC strategy (not just eGrocery):

“If traceability is important to your business, you’ve got to scan each individual item at every single point across the supply chain. You’ve got to take out the warehouse onto the first trunk, off that first trunk, onto the second trunk, off that second trunk, into the final mile delivery depot, whether that is a fulfilment centre or dark store, and out of that final mile delivery point and onto the van, scooter, HGV, whatever it might be, for the final mile delivery, where they scan it at the point of delivery.

This level of traceability is particularly important when dealing with perishable items with sell-by dates such as meats and fish. Good traceability systems, minimises the distribution of unsafe or poor quality products, which can have a multitude of repercussions for any business, especially those within a high compliance sector, and the consumer.”

For Ocado, traceability is being used for another reason – to ensure waste levels continue to be market-leading.

Every single item has to be tracked and accounted for throughout the entire supply chain – from production to the end consumer. Reducing preventable food waste helps to boost profits and mitigates energy consumption, which is why Ocado’s business model is centred around minimising waste.

Traceability technology is utilised by Ocado to promote transparency across the whole supply chain and reduce the time that the eGrocery company and their suppliers spend checking and chasing stock, particularly when it is in transition.

Warehouse automation

“Removing several of the typical human processes from grocery retail and distribution helps us to continuously improve efficiencies and drive down our cost to operate. Reducing this cost to operate is a critical driver of our economics as we scale.” – Ocado

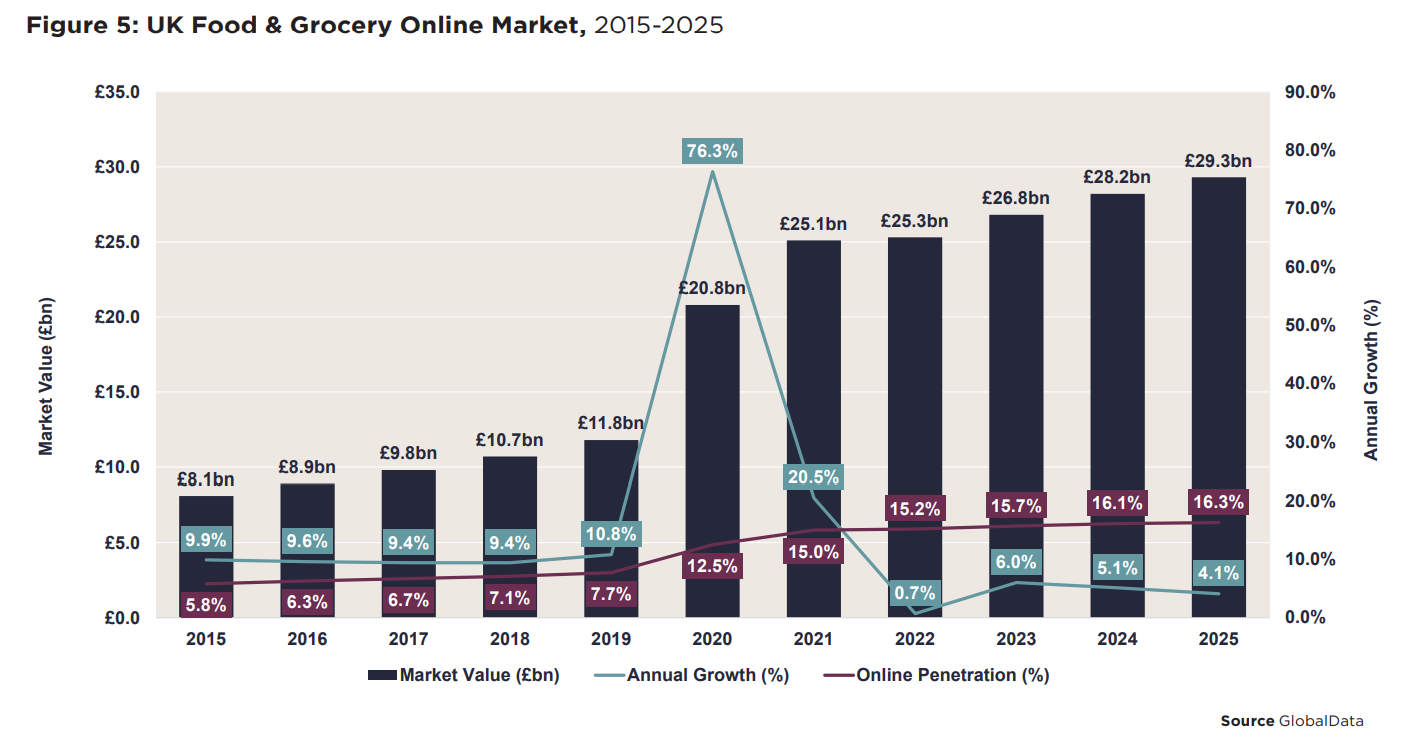

Research by Guidance Automation has found that confidence in intralogistics automation technologies is high among businesses in the aftermath of the pandemic, and remains an area of high priority for investment.

Companies clearly want to push forward with automation – both to future proof the business and achieve a far more scalable operational model.

Infographic by Guidance Automation

A prime example of a company who have fully embraced automation is Ocado, who have created the most advanced automated warehouse systems for online grocery in the world.

The various advanced technologies at their Customer Fulfilment Centres (CFC) allow them to fulfil large and complex grocery orders in the fastest way possible, and they recently unveiled that they have invested in a range of technologies, such as automated grocery picking, to help it win new corporate customers and compete with the likes of Getir and Gorillas.

In their ‘business explained’ series they allude to the types of technologies they utilise in their warehouses to streamline their intralogistics. They highlight some of their functions in detail:

Artificial intelligence-powered (AI) demand forecasting engines, product sorting

Ocado has developed advanced AI technology to predict what customers are most likely to order at any time in the week, month, or year, thanks to a wealth of stored data and advanced pattern recognition software. This gives customers’ vast volumes of choice and high availability. It also means that the CFCs’ stock is balanced accurately, contributing to very low food waste. Ocado’s waste level is market-leading at around 0.4% of sales.

Jordan Westley, eCommerce and order management system (OMS) expert at Mintsoft offers insight into the benefits of automated inventory control, whilst highlighting to the importance of packing efficiency in fulfilment centres such as Ocado’s:

“Replenishing or managing optimum inventory levels and multiple SKUs across multiple sites can be a challenging task for warehouse operatives, and can often slow operations down. When it comes to urban and micro-fulfilment, there is no room for errors as picking, packing and shipping needs to be completed as quickly as possible.

Using technology such as an Order Management System (OMS) allows automation of tasks when it comes to managing stock across multiple warehouses, by providing real-time order management. This allows users to track stock across multiple warehouses – even down to the row and exact shelf (bin) location, ensuring fulfilment centres are equipped to deliver thousands of orders per day.

An OMS also provides visibility of stock across multiple warehouses and can map orders coming through thanks to the array of different integrations the system can connect with. This means warehouse operatives will never miss an order coming in as they’re alerted of them in real-time, and stock levels are automatically synced across all warehouse locations and sales channels.”

In Ocado’s CFCs, they also use AI to let the pickers know which bag to put an item in – ensuring one bag doesn’t become too heavy, or tins are placed with soft fruit that might bruise. This saves time and means that customers can unpack their bags quickly and methodically as everything is pre-sorted.

Advanced automated bots

Ocado’s automated bots constantly record data while on the sorting grid – roughly 5,000 data points 1,000 times per second. They use this data to ‘self healthcare’ and let engineers know when they need taking in for maintenance. Unforeseen downtime can therefore be reduced in advance to ensure that the requisite number of bots are operating at any given time and their operations are uninterrupted.

AI simulations

Ocado runs simulations to build ‘digital twins’ (exact virtual replicas of their CFCs) to uncover new efficiencies in their processes. In excess of 620,000 simulations, covering over two million hours of warehouse run time, were run in 2020.

Ocado act as a paragon for the immense change and growth seen within intralogistics over the past couple of years, and the successful implementation and utilisation of advanced automation technologies have contributed greatly to their success.

The advanced nature of the bots and AI that they have implemented in their CFCs highlights how far intralogistics has progressed from the constraints of manual labour, whilst offering insight into what the future holds for fulfilment centres.

eGrocery

“eGrocery has been an emerging trend for a while, but it was the pandemic that flipped traditional retail upside down in 2020, and the phenomenon really began to accelerate. The challenge ahead for grocers is to build a sustainable infrastructure that aligns with customer demands.” – ElementLogic

Due to the Covid-19 pandemic the eGrocery market has seen a fast paced emergence of on-demand online grocery delivery services, such as Getir and Gorillas, that offer almost instantaneous delivery times.

Even fast food delivery brands, such as Deliveroo, Just Eat and Uber Eats, diversified their product offering to include delivering groceries when restaurants were closed during lockdown in order to bolster their revenue streams.

The concept of being able to order your weekly grocery shop via a mobile application was alien just a few years ago, but due to a permanent shift in consumer behaviour throughout the Covid-19 pandemic, the 10-minute delivery business model has become mainstream and continues to go from strength to strength.

Getir’s is currently valued at £9.8 billion and generated £1 billion in 2021 alone, while competitor Gorillas aims to achieve the same £1 billion feat in 2022, such is the popularity of the instantaneous eGrocery delivery model.

Element Logic’s analysis of the industry attributes the success of such businesses to the efficiency of their intralogistics solutions, and their ability to provide the ‘required speed and inventory control to win consumers.’

Another example of an eGrocery company who have experienced exponential growth over the past couple of years, is Swedish company Matsmart.

Matsmart have streamlined a variety of intralogistics processes to such an efficient extent that it enables them to sell groceries that would otherwise be disposed of due to: overproduction, improper packaging, seasonal trends, or short expiration dates, for significantly reduced prices online.

Their eGrocery business model was a success and Thomas Karlsson, Managing Director in Element Logic Sweden attributes their success to the ‘durable’ and ‘cost-efficient’ nature of their intralogistics, which has enabled them to be profitable and win long-term customers.

Want to learn more about the trends driving intralogistics?

Download Elemenlogic’s ‘Three Emerging Trends Shaping Intralogistics’ whitepaper here

Frequently Asked Questions

Think of intralogistics as movements within the four walls of a warehouse, distribution and / or fulfilment centre. Practitioners optimise, integrate, automate, and manage logistical movements within those centres.

eGrocery is a business to consumer e-commerce for the primary purpose of selling groceries online. It concentrates on customer value, shopping convenience, quick door step delivery.

A large retail facility that resembles a conventional supermarket or other store but is not open to the public, housing goods used to fulfil orders placed online.