Research conducted by Auctane in association with Metapack has assessed the upcoming ecommerce delivery trends that should be prevalent throughout 2023, and how shifting consumer and economic landscapes will shape them.

More than 8,000 consumers across eight countries (UK, USA, Australia, Germany, France, Italy and Spain) were surveyed to gauge their shopping behaviours and how these will help to determine the key trends that will shape ecommerce and delivery.

The report is divided into two sections:

- The first focuses on the current global retail and consumer landscape – contextualising the macro forces and inflationary pressures that consumers and retailers currently face, and will continue to contend with for the foreseeable future. This can be viewed as ‘the cause’.

- The second outlines the key online delivery trends that have emerged as a consequence of shifting consumer behaviours that are a product of the forces and pressures addressed in the first section. Trends such as cost over convenience shipping, sustainable delivery and ‘recommerce’. This can be viewed as ‘the effect’ – the result or aftermath of the cause.

1. Introduction: The Global Retail & Consumer Landscape

Throughout 2023 retailers will have to contend with two major headwinds: global economic uncertainty and rising geopolitical tensions, as the fallout from the Covid-19 pandemic continues.

High inflation, ever-increasing interest rates and inflated living costs will all affect consumer behaviour, with many re-evaluating how they shop and to what extent due to anxiety over their finances.

84% of consumers are concerned about the future outlook of the economy and their personal finances over the year ahead, with inflation being their top concern.

As such, retailers have to adapt to the changing landscape of the consumer so that they are in-tune with new trends, whilst also contending with demand-side issues that will see consumers spend less.

This is in tandem with rising borrowing costs, labour shortages and supply chain issues, to name but a few challenges which should culminate to create a tumultuous year for retailers, particularly those that are ill-prepared for the challenges ahead.

1.1 Cautious Consumers: Polarised Shopper Behaviours

As consumers begin to feel the full weight of deteriorating economic conditions worldwide, almost three in four (73%) say they will change their shopping habits in 2023, and just a quarter (27%) intend to continue spending as normal over the course of the year.

This will cause consumer behaviour to respond in a number of ways – some will curtail their spending and look on the market for cheaper alternatives to their usual brands (the surging popularity of buying second hand products gives credence to this), while others will only shop when absolutely necessary.

The report categorises four types of shoppers that will shape the coming year for retail:

- Necessity Shoppers: They will make purchases only when necessary

- Postponers: They will try to delay their shopping or purchase less often

- Value Hunters: They will switch to cheaper brands or retailers

- Carry On Spenders: They will purchase as normal.

As consumers and their shopping motivations shift from one end of the spectrum where purchasing behaviour will continue as normal, to the other end where purchases will be made out of necessity, new ecommerce delivery trends will develop as the priorities of the masses begin to change.

In terms of shifting delivery priorities, the study identified three key trends that will develop throughout 2023: ‘recommerce’, cost over convenience and green/sustainable delivery.

2. ‘Recommerce’: Surging Popularity for Second Hand Products Suggests Consumers are More Environmentally & Financially Conscious

Consumer habits in regards to buying second hand products have changed over recent years and the surging popularity of resale platforms, such as Depop and Vinted, suggest that the trend is set to continue.

Perceptions have changed – where before there were often stigmas attached to buying second hand goods, particularly clothes, consumers now shop for second hand bargains more than ever.

According to GlobalData the cost of living crisis will drive more consumers towards secondhand fashion than ever, with the global apparel resale market set to grow 85.5% between 2022 and 2026 to $338.4 billion.

“The global apparel resale market has grown rapidly over the past few years as new online platforms have emerged, and sustainability concerns have grown in tandem with consumer desire for more affordable fashion.” – Global Data

Resale platforms not only offer a more affordable option for money-conscious consumers and an extra revenue stream for sellers, but they also meet the growing desire to minimise their impact on the environment.

As sellers are in control of the packaging process they can recycle by using old envelopes or packaging from other purchases, as well as walk to their local Post Office should it be convenient, giving them the freedom to determine their carbon footprint and the wider impact they have on the environment.

Customers also have the piece of mind knowing that they are buying recycled and reused goods, limiting the impact of overconsumption whilst buying products at an often heavily reduced price compared to retail.

Retailers are cottoning on to this trend too – clothing retailers Next, Shein and PrettyLittleThing have recently launched their own online peer-to-peer resale platforms to rival the likes of Depop.

IKEA is also trialling a ‘Buyback & Resell’ service where customers can recycle their unwanted IKEA furniture for cash or credit.

From a retailer’s perspective it continues their customer acquisition process and loyalty cycles, as the revenue raised from the returns could be reinvested back into other products from the same retailer, keeping them within their ecosystem.

2.1 Delivery Priorities Are Changing: Cost Over Convenience Ecommerce Delivery Trend Gains Traction

As highlighted previously, consumers’ online shopping priorities are changing rapidly in response to economic pressures. As a consequence, the cost of delivery has become a key conversion factor for consumers, who are now prioritising saving money over convenience.

Throughout the pandemic consumers become accustomed to fast delivery, with most being willing to pay for quicker delivery times in order to receive their goods as soon as possible.

However, with financial pressures shrinking the pockets of the consumer, many are willing to forego such privileges and make concessions on their typical delivery preferences (typically next day or same day delivery) in favour of waiting three to four days for free delivery.

The data suggests that consumers are as cost-conscious as ever in 2023, with the cost of delivery being the number one priority or deciding factor when purchasing online.

“We are facing high risk of recession, wants will be set aside for needs and customers will nit-pick delivery costs.” – Parkers AE

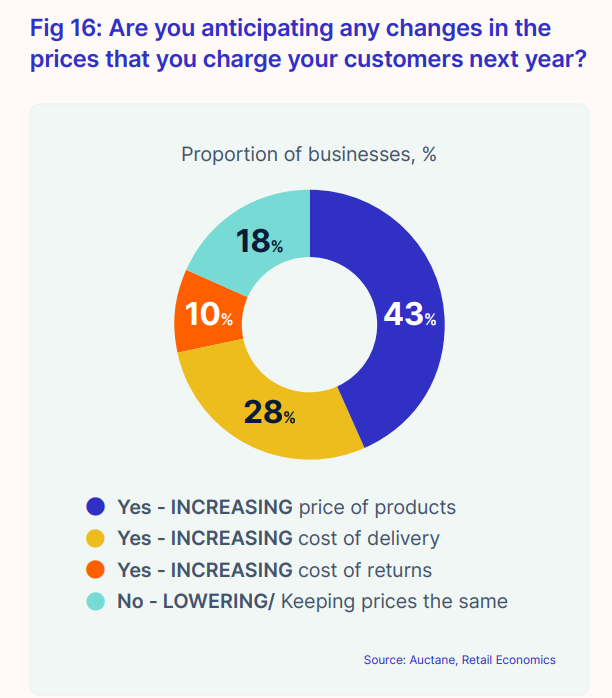

Due to inflation, supply chain issues and a variety of other pressures eating into the profit margins of retailers, many are facing a tough decision regarding their pricing policies across the board, as represented by the graphic below (Fig 16).

Over a quarter (28%) of retail businesses plan to increase the cost of delivery for their customers in 2023, with only 18% planning not to increase the price of products, delivery, or returns.

It creates a headache for consumers who are shopping for price over convenience, yet prices are rising regardless.

“But this is a risky strategy in a fiercely competitive retail landscape where consumers are squeezed. As shoppers’ priorities shift towards value, consumers would generally be more open to waiting longer for delivery, or compromising on location, than paying for delivery. In the current economic environment, free postage and a small wait for delivery (3-5 days) is likely to trump paid-for expedited delivery.” – Auctane

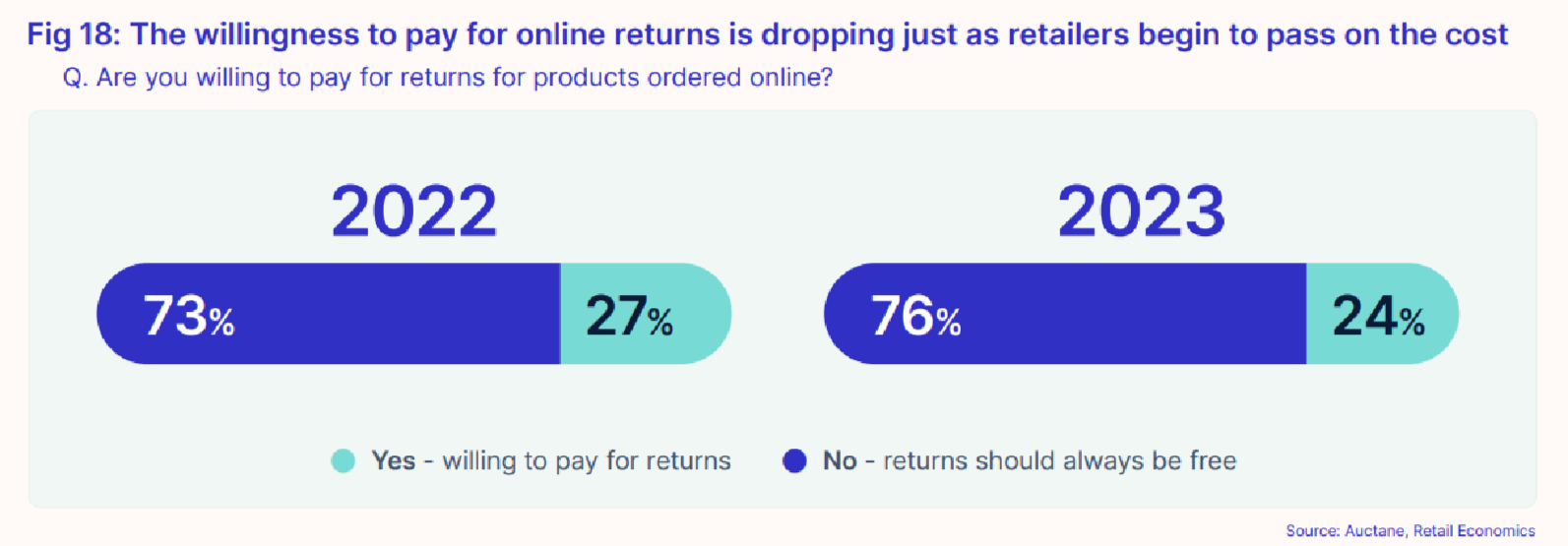

Major retailers, particularly in industries with high return rates due to ‘bracketing’, such as the fashion industry, are pivoting from free returns to paid returns en masse.

According to data from the National Retail Federation, consumers sent back around $100 billion worth of products bought online in 2020, and in 2021, that amount more than doubled to around $218 billion.

The NRF also found that the average retailer sees $166 million in returns for every $1 billion in sales, so it is unsurprising that retailers such as Next, Zara and Boohoo have changed their returns policy over recent years.

Despite this adding an extra source of revenue, return fees risk alienating customers, particularly as it has become an industry standard in the eyes of the consumer, and a luxury many have come to take for granted.

More than three quarters (76%) of shoppers surveyed in the study believe returns should always be free.

2.2 Sustainability: Consumer Appetite for Green Deliveries Gains Prominence

Irrespective of economic pressures, research has shown that consumers are increasingly looking for sustainable delivery options when purchasing online, even if it costs extra or delays delivery times.

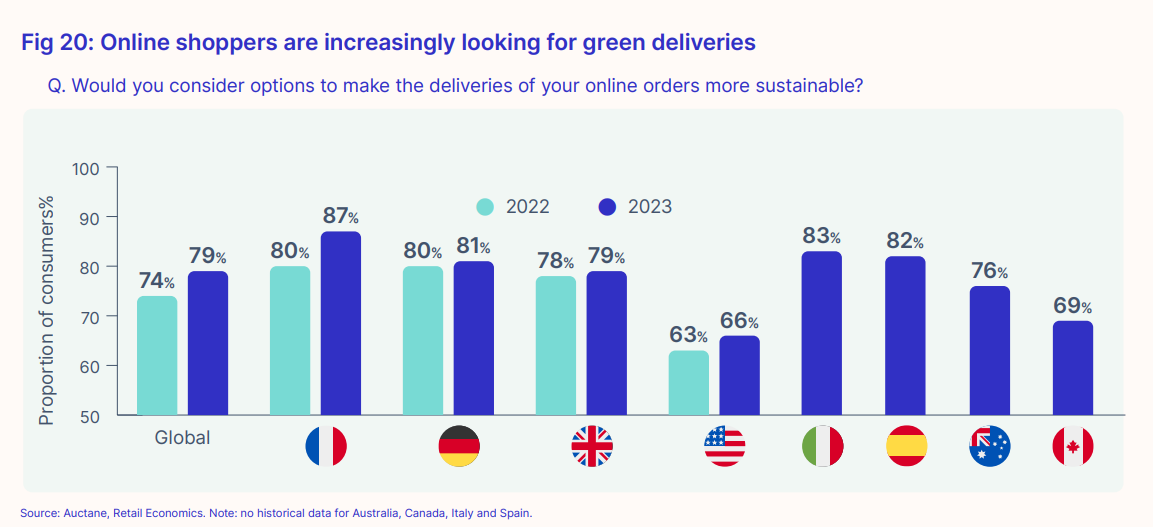

Globally, almost 4 in 5 (79%) shoppers value having ‘green’ delivery options when ordering online, up from 74% the previous year.

Out of home delivery, options such as click and collect are becoming increasingly popular with consumers since they offer a convenient (and often free) delivery choice that benefits the retailer, the consumer and the environment.

Multiple orders can be dropped off to a single location as opposed to multiple individual locations, reducing the number of last-mile deliveries and cutting carbon emissions through reduced mileage.

For some consumers who conveniently pass the pickup location on a daily basis it’s a no-brainer. They’re afforded the flexibility to collect the parcel at their leisure as opposed to being tied to specific delivery windows provided by the courier.

It also offers a safer alternative to packages being left on the customers premises, since ‘postal piracy’, more commonly known as postal theft (the act of packages or parcels being stolen), is becoming an increasingly common issue.

Sustainable delivery options of the like are key to progressing towards a greener last mile and should be popular throughout 2023 among consumers.

However, retailers aren’t entirely sold just yet.

According to the study less than a fifth of businesses consider the environmental impact of deliveries a key strategic focus, with their priorities being elsewhere.

Shifting consumer behaviour could change that as retailers change tune to meet this trend and adapt to the priorities of the customer, in order to boost loyalty and revenue.

If you’d like to read an updated version of this article, read our ‘The Delivery Trends You Need to Know into 2025‘ blog.

Frequently Asked Questions

Recommerce combines ‘reselling’ with ‘ecommerce’ and is the act of selling second hand goods online. Popular examples of recommerce stores are Ebay, Depop, Vinted and Gumtree.

Cost over convenience, sustainable deliveries and recommerce.

Postal piracy (more commonly known as package or parcel theft) is the act of a delivery package being stolen off a person’s premises. It is a crime that can result in jail if the perpetrator is prosecuted.