How Supply Chain Innovation Will Enable Next-generation Healthcare

A report by DHL, Delivering Next-Level Healthcare, has analysed how supply chain and logistics innovations are facilitating new approaches to healthcare.

Healthcare systems across the globe are changing rapidly in the wake of the COVID-19 pandemic.

Accessibility, efficiency, and depth of choice have come increasingly into focus, affecting where, when, and how health services are delivered.

Today, these rapid changes are placing new demands on healthcare logistics and supply chains, and DHL attributes these changes to a combination of key technological, social, and economic factors:

1. Rapid advances in medical technology.

These advancements require us to completely rethink pharmaceutical supply chain models – from methods of delivery to whole delivery network structures. Cryogenics, for example, can create temperatures as low as -196°C, taking cold chain logistics and the transportation of medicines to newfound extremes.

2. Unprecedented global events.

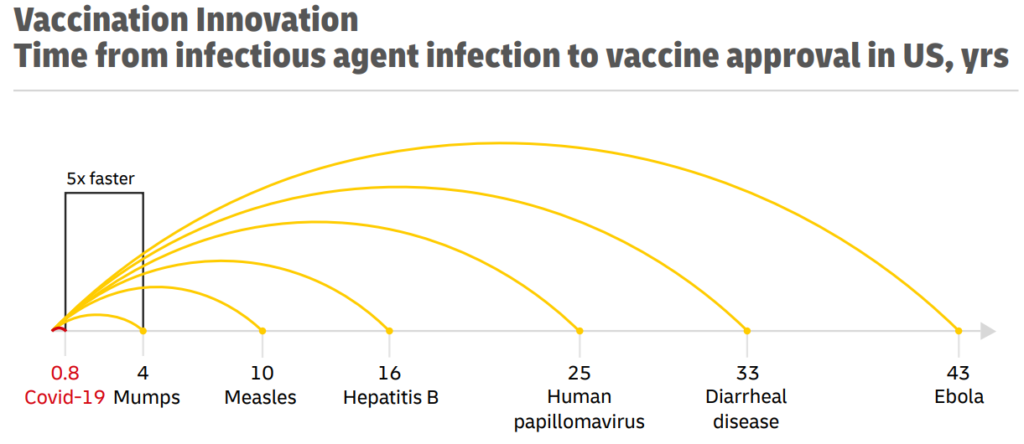

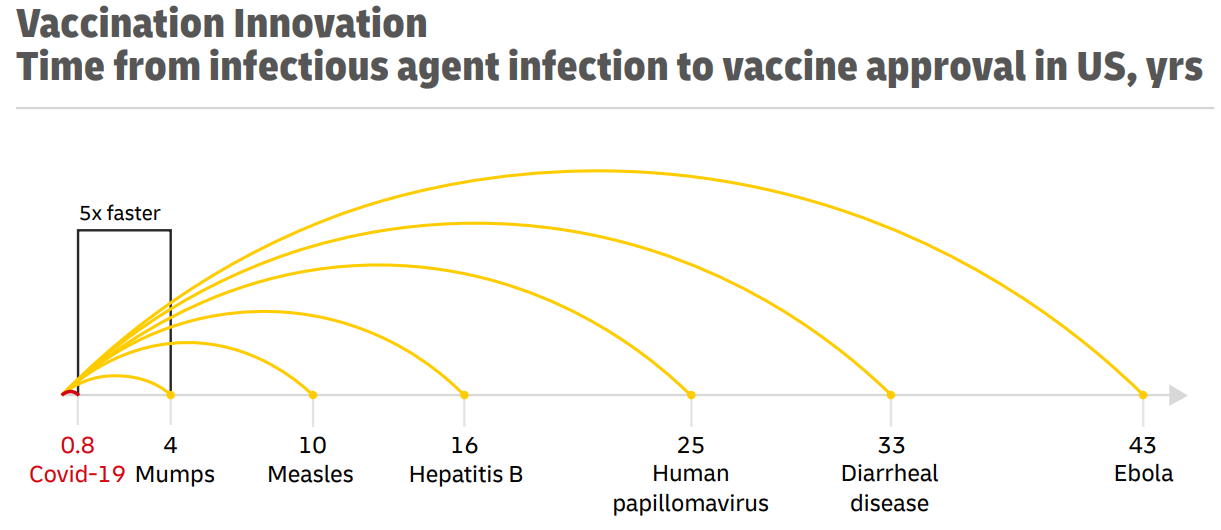

The COVID-19 pandemic, and the lasting effect it has had on society, has redefined pharmaceutical supply chain expectations. The development and deployment of the COVID-19 vaccine set new records – the vaccines were developed ten times faster than in conventional processes, highlighting the efficiency of modern healthcare logistics and supply chains like never before, while also setting new precedents.

3. Broader social trends.

Healthcare consumer behaviours are constantly shifting, and this demands a flexible supply chain that is as resilient as it is responsive. Behavioural shifts, for example, can be seen through newly-established patient preferences – 62% of patients say they would welcome the option of virtual reality (VR) healthcare services, drastically changing where and how they receive their healthcare.

Six major trends in pharmaceutical logistics that are reshaping healthcare delivery

Following analysis of these key drivers of change within healthcare, DHL’s report proceeds to explore six major trends that are emerging as a by-product of these factors. These evolving trends are drastically changing the way healthcare products and services are delivered, placing fresh demands on existing supply chains, logistics processes and the ways in which they are managed.

Patient-centric healthcare

Pharmaceutical supply chains are evolving, from being primarily designed to cater to centralised treatments, to prioritising personal treatments that require closer links between pharmaceutical manufacturers and patients.

Contemporary patients now strive for the same element of choice and convenience that is commonplace in commercial marketplaces, and these newly developed preferences are driving growth and change in the consumer healthcare segment.

Advanced therapies

Advancements in technology and education are facilitating new approaches to medicine. Complex cell, gene therapies, and other intricate biopharmaceuticals, for example, that are delicate and expensive, and require a tightly monitored two-way supply chain with rigorous control in order to maintain their efficacy.

This has prompted significant investment in cold chain logistics, from conventional refrigerated shipments to ultracold, frozen product supply chains that require cryogenics.

“Revolutionary therapies reflect the accelerating pace of medical progress and set the stage for a transformative shift in life sciences and healthcare delivery with patient-centric models, digital technologies, and environmentally conscious practices.”- Claudia Roa, President, Life Sciences & Healthcare Sector, DHL Customer Solutions & Innovation.

Digital healthcare

The COVID-19 pandemic fuelled a short-notice, rapid expansion in remote healthcare solutions, to such an extent that even decentralised clinical trials became frequent. Shipments of urgent, sensitive, and temperature-controlled medications directly to patients became prioritised over in person collection in centralised locations (pharmacies, hospitals etc) in order to adhere to lockdown rules and curb the spread of the virus.

This decentralisation relies on good pharmaceutical supply chain management that is backed by advanced technology in order to be effective. Advanced technologies such as sophisticated sensors that monitor the location and condition of shipments and asset-tracking technologies are helping to add visibility and resiliency to the chain for easier supply chain management.

New ecosystems

The COVID-19 pandemic set new records for the speed of development and distribution of vaccines, which has had a lasting impact on logistics since. Large healthcare providers are increasingly turning to third- and fourth-party logistics providers to fast track the flow of crucial medicines and technological devices throughout the supply chain at record speeds.

Sustainable solutions

Estimates from the World Health Organisation put into perspective the excessive amount of plastic waste the global healthcare sector generates. The industry expends over 300 million tonnes of plastic waste every year.

Investment in carbon-neutral warehousing and sustainable (and returnable) packaging options are two key supply chain initiatives currently being undertaken to help to reduce this figure. Other key areas of priority investment include alternative fuels and alternative drivetrain methods, in addition to optimised delivery and inventory models will help further reduce the industry’s carbon footprint.

Resilience

The strain placed on global pharmaceutical supply chains throughout the COVID-19 pandemic brought into focus the need for future-proofing them against other unprecedented events. Dubbed the ‘great supply chain rethink’, more localised supply chains for essential healthcare products and insourcing of critical pharmaceuticals, active ingredients, and medical supplies will create a more resilient supply chain that caters to accessibility.

Eight key impacts these trends will have on next-gen pharmaceutical supply chains

After outlining the six major trends in pharmaceutical supply chains that are required to deliver next-level healthcare, DHL’s report highlights eight supply chain management models that should be established, in order to support them.

Cold chain logistics capacities

The exponential growth of advanced therapies such as biopharmaceuticals will prompt increased volumes of temperature-controlled shipments, creating a surge in demand for flexible cold chain logistics networks. These networks must retain the scale, versatility, and agility to handle extreme temperatures (as low as -196°C) and meet compliance requirements throughout without compromising on quality.

White-glove logistics service

Logistics providers have to demonstrate that they understand the needs and sensitivities of healthcare logistics, in order to flawlessly deliver patient-centric medicines.

This requires accuracy and precision, especially during direct pickups and handoffs to the patients.

Direct-to-X delivery models

As healthcare delivery models and user preferences evolve, products are reaching their end-users in diverse ways. Traditionally the industry has operated on a business-to-business model.

Pharmaceutical companies are increasingly shifting from supplying dozens of distributors to a diversified, omnichannel model that includes direct-from-manufacturer and direct-to-patient models, ultimately bypassing traditional distribution channels.

Supply chain optimisation

The emergence of more personalised supply chains and direct delivery models makes pharmaceutical supply chain management much more complex.

Stakeholders will need to adopt smart supply chain strategies such as segmentation to enable different processes, material flows, and service levels for different customer and product groups.

Inventory optimization

High product availability is imperative to the pharmaceutical supply chain, but big inventory buffers in the industry (additional inventory kept on-hand in case of emergencies, transportation delays, or surges in demand) increase costs and the risk of obsolescence.

Advanced inventory control methods such as demand forecasting, end-to-end visibility, and AI planning tools will help to cut costs without compromising efficiency.

Digital technology

Modern cloud-based control tower solutions that leverage advanced technologies – such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) – will be utilised in order to eliminate blind spots in the supply chain and create higher visibility over shipment locations and their status.

Sustainability

The healthcare sector is responsible for almost 5% of global greenhouse gas emissions, so there is vast amounts of pressure on the industry to decarbonise, with transport and packaging being two key areas of focus.

Stakeholders are increasingly turning to load and asset sharing, alternative fuels, alternative modes of transport, and eco-friendly packaging solutions in order to decarbonise.

Compliance

Rapid advances in technology prompts the regulatory environment to consistently evolve in response, creating a number of complexities for providers to continually adapt to.

Providers who pre-emptively identify and acquire the supply chain capabilities they need, to comply with regulatory changes, increase their chances of success.

Conclusion

In summary, DHL’s report demonstrates the healthcare sector’s supply chains and distribution methods are changing, as driven by technological advances and the evolving demands of patients, providers, regulators, governments and broader social trends.

These changes will ultimately require the sector to rethink its supply chains, and in some cases invent entirely new supply chain models. These key supply chain and logistics capabilities will underpin the delivery of next-generation healthcare systems and their consequent success.

Download the full report here: Delivering Next-Level Healthcare