In the constantly evolving world of e-commerce, shipping and fulfilment are no longer just background operations – they’ve become the frontline of customer experience, directly impacting brand reputation, loyalty, and a business’ bottom line.

The recent Linnworks Shipping and Fulfilment Report 2025 highlights how crucial it is for online retailers to adapt to continuously evolving consumer expectations and to overcome significant challenges in order to thrive.

Their report helps retailers understand how to turn their shipping and fulfillment operations from a liability into a competitive advantage.

Whether retailers use a network of couriers or deliver products in their own fleet by embracing technology, flexibility, automation and collaboration they can optimise logistics, control costs and, perhaps most importantly, improve the experience for consumers ‘beyond the buy button’.

Commenting on the report’s findings, Laura Barber, Partner Manager at Linnworks said:

“Complexity is the new normal. Retailers are managing multiple marketplaces, increasingly fragmented fulfillment networks and rising customer expectations. Manual processes simply can’t keep up — and they shouldn’t have to.

“This is where Linnworks becomes a strategic enabler. By centralising inventory, order management and shipping workflows across all selling channels, Linnworks eliminates the silos that create bottlenecks and errors. Instead of relying on disconnected spreadsheets and systems, retailers gain a single source of operational truth.

“Automation is the key advantage. From real-time inventory syncing to intelligent order routing and automated shipping label generation, Linnworks enables retailers to scale operations without scaling headcount. This is particularly critical as sellers expand into more marketplaces like Amazon, TikTok Shop, Temu, and Walmart. With Linnworks, the addition of new sales channels doesn’t translate into operational chaos, it becomes a seamless extension of an integrated commerce operation.”

Automation is something that Vinod Kotecha, Managing Director at our Linnworks integration partner, Rishvi, also highlights when we asked him about the shipping report:

“When retailers integrate Linnworks with their wider fulfillment ecosystem—whether it’s couriers, WMS, or ERP—they unlock real-time visibility and eliminate manual touchpoints. This kind of automation not only accelerates order processing but also reduces errors, improves inventory accuracy, and ensures customers receive timely and consistent updates throughout the delivery journey.

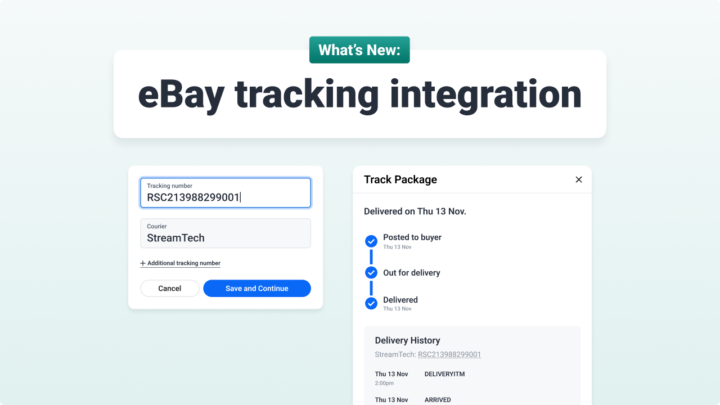

“For Linnworks users, integrating with platforms like Stream unlocks end-to-end automation—from order routing to carrier label generation and tracking. This seamless connection minimises manual steps, accelerates dispatch times, and ensures shipping operations scale smoothly with order volume.”

Let’s now look at those challenges facing retailers – and how to solve them.

Key challenges facing online retailers in 2025

Retailers today face a double-edged sword of rising costs and escalating consumer demands, among a series of other challenges and complexities.

Rising costs, rising expectations

40% of retailers identified the cost of shipping as their biggest e-commerce challenge.

Consumers are increasingly expecting fast, free, and flexible delivery options, including same-day delivery.

This puts brands in a tough spot: do they either absorb these escalating costs or innovate to find new efficiencies to remain competitive and keep customers happy?

The report notes that for some retailers, shipping costs can take up as much as 15% of revenue, emphasising the critical need for cost optimisation, just not at the expense of service.

Inventory gaps & operational bottlenecks

The report highlights that only 36% of retailers believe they have full inventory visibility, while 57% admit to having minor visibility issues.

This lack of accurate, real-time inventory visibility across multiple sales channels frequently leads to overselling, shipping delays, and frustrated customers.

Such issues not only affect marketing effectiveness and brand reputation, primarily through negative reviews, but can also trigger costly returns due to incorrect orders.

Global shipping complexity

Cross-border e-commerce, while offering huge growth potential, introduces significant hurdles for retailers. In 2025, these include volatile tariffs, trade disputes, and customs delays, all due to a number of political and economic factors.

The report specifies that 35% of retailers consider managing cross-border shipping a top challenge when pursuing international expansion.

Linnworks suggest that diversifying courier networks can help build resilience against these complexities, but it also adds another layer of management and investment.

Supply chain volatility

The e-commerce landscape remains susceptible to unpredictable delays and inflated lead times due to factors like factory closures, raw material shortages, and broader global events and political tensions.

This necessitates robust and adaptable sourcing strategies to minimise disruptions while catering to ever-changing customer demands.

Sustainability vs profitability

As environmental concerns grow and stricter legislation comes into play, retailers are under increasing pressure to adopt greener logistics practices.

However, balancing these sustainable initiatives with consumer expectations for fast and often free shipping presents a considerable challenge, as eco-friendly options can sometimes be more expensive or slower in comparison to their less environmentally clean counterparts.

The report cites that 59% of retailers believe sustainable initiatives will increase shipping costs, highlighting the perceived trade-off.

Meeting consumer expectations: control, transparency, flexibility

Today’s consumers demand more than just speed; they want control, transparency, and flexibility in their delivery experience.

Laura commented:

“The triple mandate of fast, free and sustainable shipping is arguably one of the toughest balancing acts in ecommerce today – especially when retailers are managing self or own fleet delivery operations. Consumers expect all three, but fulfilling these expectations without sacrificing margin or environmental integrity requires precision strategy.”

When asked about ‘fast and free’ delivery, Laura advises:

“The first step is redefining what “fast and free” really means for your brand and your customer. Not every delivery needs to be same-day. In fact, Linnworks data shows that customers increasingly value choice and transparency. Offering flexible delivery options, including slower but greener alternatives can shift consumer behaviour while reducing last-mile emissions.

“Smart logistics plays a vital role. Retailers should use multi-carrier shipping tools to optimise rates and delivery times dynamically. Pair that with strategic 3PL partnerships or regional micro-fulfillment centers and you can reduce both cost and carbon by moving inventory closer to demand.

“When delivering in your own fleet, retailers should use delivery management software that’s integrated with their order management system. In Linnworks’ case, that’s Stream.

“Finally, make sustainability visible. Consumers are more likely to opt into slower or greener shipping options when they understand the impact. Clear communication at checkout can turn fulfillment into a moment of shared values, not just logistics.”

Real-time tracking is essential

Customers expect constant real-time delivery tracking in the form of updates on their parcel’s whereabouts, including accurate estimated delivery windows and proactive delivery notifications.

The report indicates that 39% of businesses struggle with managing delivery times, directly impacting customer satisfaction.

Offering the level of tracking transparency customers expect builds trust and reduces “Where’s my order?” enquiries, which can drain customer service resources.

Flexible delivery is the new standard

Consumers want a range of delivery options, such as custom delivery windows, delivery to secure lockers or designated pick-up points, and the ability to reroute parcels even after purchase.

The shift towards Buy Online, Pick-Up In Store (BOPIS) is also experiencing rapid growth, offering convenience and potentially reducing last-mile delivery costs for retailers.

The report highlights that 59% of retailers say ‘offering flexibility with delivery’ is a challenge, showing the widespread difficulty in meeting this demand and implementing new delivery trends.

Rethinking returns

A frictionless returns process has become a dealbreaker for many consumers – expectations include free return shipping, easy digital returns, fast refunds, and no-questions-asked exchanges.

While these conveniences enhance buyer satisfaction, they can create significant operational and financial strain for sellers.

The report notes that returns are a significant pain point for 38% of retailers.

This issue is further compounded by customers that ‘bracket’ goods.

‘Bracketing’ in e-commerce refers to the act of purchasing multiple variations of the same product with the intention of keeping one and returning all of the others, all at significant cost to retailers.

Overcoming challenges and future-proofing your shipping strategy

Forward-thinking retailers are turning these challenges into strategic advantages through:

Diversify courier networks

Over-reliance on a limited number of shipping partners can lead to higher costs, increased risk, and potential delays.

By diversifying their courier networks, retailers can reduce risk, negotiate better rates, and offer a wider array of faster, more flexible delivery options.

Multi-carrier software plays a crucial role in automating rate comparisons and optimising carrier selection for each shipment.

Balance delivery times and costs

Smart route scheduling, strategic 3PL partnerships, and hybrid delivery models can reduce last-mile expenses.

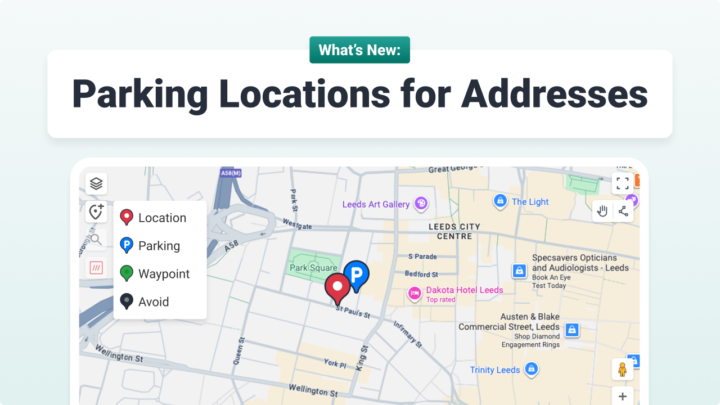

Route planning and route optimisation tools help to balance delivery times and cost too, while offering locker pick-ups or click-and-collect options are also recommended to retailers.

Optimise returns

Retailers must focus on reducing return volume through better pre-purchase experiences and streamlining the return process with automation and clear policies.

Improving product detail pages, offering exchange incentives, and using return data to identify common issues for improvements are all vital.

Strategic free shipping

Blanket free shipping policies can significantly erode profit margins.

The report suggests aligning free shipping offers with high-margin products, loyalty programmes, and spend thresholds to encourage larger purchases and boost Average Order Value (AOV), making free shipping a strategic marketing tool rather than a universal cost.

Packaging optimisation

While sustainable and durable packaging can sometimes be more expensive, oversized or inefficient packaging directly drives up shipping costs due to dimensional weight pricing.

Optimising materials, standardising package sizes, and embracing technology for smarter packaging not only reduces costs but also minimises environmental impact.

Centralised logistics management

Fragmented systems often lead to costly errors, delays, and a lack of holistic visibility.

Centralising operations with platforms like Linnworks unifies the back-end, automates workflows, and provides real-time inventory visibility across all sales channels, leading to more efficient and accurate fulfilment.

Trends shaping the future of shipping and fulfilment

Supply chain innovation is rapidly reshaping fulfilment, driven by technology and evolving consumer behaviour.

Personalised delivery

Customers are increasingly demanding delivery on their own terms, including preferred time slots and specific pick-up locations.

Retailers must invest in systems that allow for real-time delivery customisation and offer a spectrum of choices to meet customer preferences.

High-tech packaging optimisation

Driven by eco-conscious consumers and rising carrier fees, retailers are re-evaluating their packaging strategies.

AI and software tools are being deployed to optimise box sizes, minimise void filler, and source lighter, more sustainable materials, reducing both cost and environmental footprint.

Digital supply chains & blockchain transparency

Blockchain and other digital supply chain technologies, such as complex barcode tracking systems, are bringing unprecedented levels of transparency and traceability to e-commerce logistics.

This enhanced visibility is becoming a key differentiator, especially with increasing scrutiny around ethical sourcing and sustainability practices.

AI-Powered fulfilment

AI is quietly reshaping the entire fulfilment pipeline – from forecasting demand and optimising warehouse inventory to planning delivery routes and predicting delays.

AI across the supply chain is helping to reduce errors, speed up decisions, and enable chain agility.

Last-mile innovation

The last mile of delivery is experiencing a revolution, with new delivery trends ranging from pavement delivery robots and drones to autonomous vans.

These technologies are designed to drastically cut delivery times, lower carbon emissions, and reduce human dependency, particularly during peak demand periods.

Examples include companies integrating large parcel locker networks like Amazon and Transport Management Systems like Stream to cut operational costs and failed deliveries.

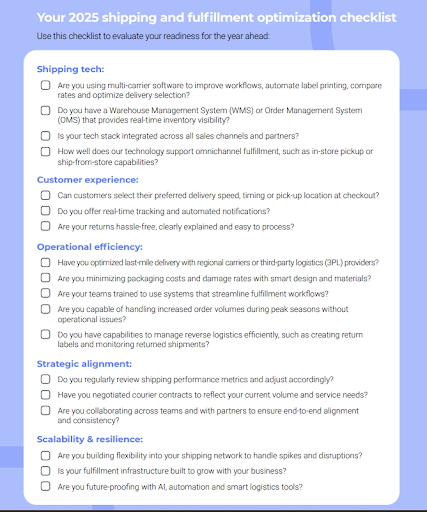

Your shipping and fulfilment optimisation checklist

Linnworks’ report also includes a shipping and fulfilment optimisation checklist, which includes a series of questions to help businesses determine their operational readiness, as seen below.

Shipping & fulfilment strategy 2025: courier vs. fleet Operators

Let’s take all the elements of the Linnworks’ report and put them together into a summary table.

| Category | Courier/3PL retailers | Own fleet retailers |

| Top priority | Optimise your courier mix and integrate automation into your shipping strategy (hint: Linnworks) | Maximise delivery efficiency with logistics technology for streamlined operation |

| Technology investment | Multi-carrier shipping software, OMS/WMS functionality, multi-channel operations, automation tools | Route planning software, delivery tracking, fleet optimisation, integration with inventory/order/WMS systems |

| Delivery expectations | Offer multiple speed/cost options; partner with faster couriers | Provide real-time tracking, dedicated time windows, rerouting options |

| Real-time visibility | Integrated tracking from warehouse to door with couriers | GPS-enabled fleet and delivery tracking; automated customer notifications; operational visibility on day-of-delivery |

| Returns management | Work with returns platforms (e.g., Loop, Sendcloud); streamline reverse logistics | Enable in-house return pickups or partner lockers for returns; explore returns through couriers or returns platforms |

| Cross-border / international shipping | Use multi-carrier networks to manage international complexities; explore offerings from Amazon, Walmart & other marketplaces to minimise risk as you explore & expand | Consider hybrid delivery + 3PL support for international or long-haul deliveries; explore offerings from marketplaces such as Amazon and Walmart |

| Sustainability focus | Carbon-neutral shipping, eco packaging, incentivise slower / optimised delivery options | Optimise routes, fleet utilisation, differentiate delivery speed optional, electrify fleet, use reusable packaging, optimise fleet utilisation, barcode scanning to ensure right orders on right vehicles, order tracking to minimise failed deliveries |

| Packaging optimisation | Use smart packaging tools & standard box sizes to cut costs and waste | Reduce material use, train teams on packaging & handling best practices |

| Scalability strategy | Add regional & international couriers and automate fulfilment processes | Build regional hubs, use overflow drivers, collaborate with local micro-fulfilment |

| Customer control features | Flexible delivery choices at checkout & real-time delivery status | Required times scheduling, delivery location flexibility, real-time delivery tracking, locker support |

| AI use case | Demand forecasting, dynamic courier selection, inventory sync | Route optimisation, delivery volume forecasting, shift scheduling |

| Operational bottlenecks solved | Disjointed courier performance, manual workflows, returns chaos | Inefficient routing, siloed teams, tribal knowledge in transport teams, limited visibility, poor data and analytics, inconsistent customer experience |

| Tech stack example | Linnworks + ShipStation + Loop + 3PL integrations | Linnworks + transport management software (i.e. Stream) |

| Returns innovation | Returnless refunds, exchanges over refunds, automated workflows | Smart pickups, rules-based return approval, mobile app integration |

| Cost-saving tactics | Rate shopping, multi-carrier negotiation, packing optimisation | Optimised routes, fuel reduction, localised delivery hubs / depots |

| Collaboration strategy | Integrate 3PLs, marketplaces, carriers through open APIs | Align drivers, warehouse, and CS teams around shared delivery KPIs |

| Analytics KPIs | Courier success rate, cost per shipment, customer delivery satisfaction | On-time rate, fuel efficiency, failed delivery %, OTIF |

| Future-readiness | Automation, partner ecosystem, smart packaging | Scalable fleet infrastructure, machine learning delivery routing, logistics automation |

| Brand differentiation | Speed, choice, transparency | Personalisation, control, direct brand experience at the doorstep, real-time tracking, proactive notifications |

Improvements you can make to your logistics operation today

We asked the experts from Linnworks and Rishvi what single improvement they’d recommend retailers implement this year to boost the efficiency of their logistics operation. Here’s their responses.

Linnworks

Centralising and automating your fulfilment operations.

The Linnworks 2025 report highlights 23% of retailers still rely heavily on manual processes, despite increasing order volumes and marketplace complexity.

By consolidating inventory, shipping, and order management into a unified platform, retailers can eliminate human error, prevent stockouts and gain real-time visibility across their entire operation.

Automation through platforms like Linnworks means smarter order routing, faster delivery times and proactive customer communication which are key drivers of loyalty in a competitive market. Operational agility is the competitive edge of 2025.

And it starts with replacing the manual with the intelligent.

Rishvi

If retailers focus on just one improvement this year, it should be streamlining their order-to-ship workflow.

Investing in automated shipping rules, carrier allocation, and real-time tracking updates can dramatically reduce fulfilment time and improve customer satisfaction—two essentials for staying competitive in today’s ecommerce landscape.

Let’s leave the final word to Vinod:

“Retailers using Linnworks should prioritise integrating their self delivery logistics workflows with solutions like Stream. It’s a high-impact upgrade that reduces fulfilment complexity, improves delivery accuracy, and frees up time to focus on growth.”

Conclusion

Shipping and fulfilment is no longer just a cost of doing business.

It is, in fact, crucial to business.

The brands that succeed will be those that invest early in automation, analytics, and scalable partnerships and integrations.

By proactively building resilient, efficient, and customer-centric shipping strategies, businesses not only meet, but exceed customer expectations.

Getting delivery operations right, helps retailers to drive loyalty and growth in the years to come.

For retailers managing logistics in their own fleet, the shipping and fulfilment is, by definition, more complex.

While those retailers may not rely on couriers or 3PLs, the core principle remains the same: your delivery experience is your brand promise.

By borrowing from the strategies used by high-performing courier-based operations (and discussed in the Linnworks report), you can elevate your logistics operation to the same gold standard — automated, adaptive, and customer-first.

Further reading about Linnworks

For further reading, take a look at Linnworks’ Best Online Marketplaces to Sell On in 2025 report, or, for furniture retailers, Linnworks has a report on the Key Trends Shaping the Furniture Market in 2025.

And don’t forget, Stream is integrated with Linnworks helping businesses to manage and automate their ecommerce, retail and logistics operations.