Linnworks’ latest report, Online Furniture Retailers: Key Trends Shaping the Market in 2025 has analysed the online furniture market, which highlights that the industry is experiencing significant online growth, driven by evolving consumer behaviours and technological advancements.

This surge presents a promising opportunity for furniture retailers but also introduces a unique set of challenges.

In the report, Linnworks explore the key trends shaping the industry, provide strategies to capitalise on growth, and addresses the common challenges online furniture retailers should expect to face throughout 2025 and beyond.

The growth of online furniture sales

The global furniture e-commerce industry generated £159 billion in revenue in 2024 and is projected to reach approximately £327 billion by 2029. The report attributes this growth to several factors, including the normalisation of online shopping for furniture, accelerated by the COVID-19 pandemic.

Shifting consumer behaviours

To thrive in this dynamic market, furniture retailers must adapt to shifting consumer behaviours and demands:

Fast(er) delivery

Customers expect fast, transparent delivery with real-time tracking, delivery updates through delivery notifications, and clear delivery windows to their preferred messaging channel(s). As consumer expectations rise throughout the last mile, brands that streamline their supply chain will stay ahead of the competition.

Sustainable packaging

Eco-conscious shoppers are becoming increasingly prevalent, and they expect businesses to offer (or utilise) recyclable, compostable, minimal-waste packaging when possible.

Internationalisation

E-commerce has facilitated global shopping, but despite this consumers expect localised online experiences with prices in their own currency, translated content in their native language, and affordable local shipping options.

AR/VR technologies

Augmented and Virtual Reality tools are enhancing the customer experience, allowing buyers to visualise furniture in their own homes before they purchase, empowering more informed decisions.

Flexible payment options

“Buy Now, Pay Later” (BNPL) such as Klarna, instalment plans, and lease-to-own options are becoming increasingly popular among consumers and help to boost conversion rates and customer retention.

Shift to multiple online marketplaces

Online marketplaces are crucial sales channels, with many retailers generating over 50% of their revenue through these platforms.

Amazon, eBay, and Temu remain dominant, but specialist furniture retailers like Wayfair and platforms like Etsy will continue to gain traction throughout 2025.

However, a word of caution. For sellers on Amazon who self deliver orders, changes to VTR metrics and A-Z Claims processes has caused issues for many of those sellers.

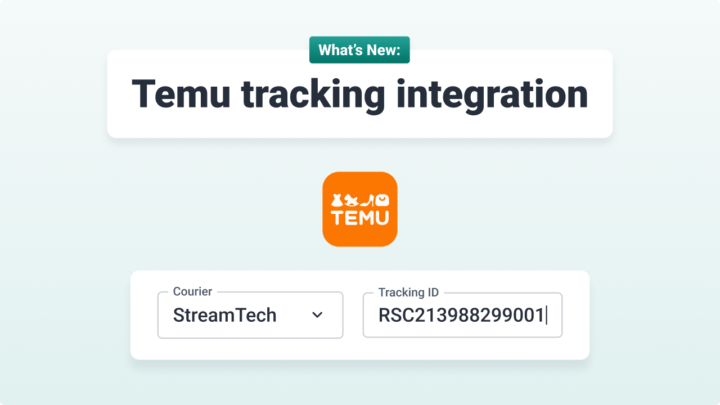

If retailers are using Stream to manage self deliveries they can use the ShipTrack integration to pass valid tracking updates back to Amazon Seller Central.

Many furniture retailers are adopting a multi-channel sales approach, listing products on seven different marketplaces on average in order to expand their reach and reduce dependence on any single platform.

Emerging marketplaces like TikTok Shop, Temu, and SHEIN are also becoming important channels for marketing furniture, particularly for Millennial and Gen-Z audiences.

Commenting on the report, Laura Barber, Partner Account Manager, EMEA, said:

“Retailers who diversify their presence across channels will undoubtedly have the edge over their competitors. However, while this multi-channel approach offers increased visibility and sales potential, it also creates challenges in inventory management and operational efficiency. Linnworks provides a range of tools and automation capabilities designed to help furniture retailers efficiently manage operations across multiple marketplaces.

“Linnworks, for instance, allows online furniture retailers to easily manage inventory across multiple selling channels from one place. This eliminates overselling, ensures efficiency and reduces manual workload. With real-time stock updates across all selling channels and connectivity to marketplaces such as Amazon, eBay, Wayfair, TikTok Shop and more, furniture retailers can have peace of mind that they will never miss out on a valuable sale.”

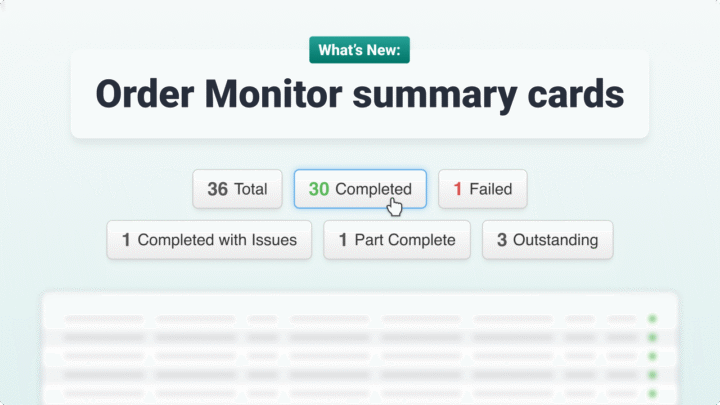

Research conducted by Linnworks in December 2024 for lower mid-market online retailers showed that 22% of the survey respondents noted managing and fulfilling different types of orders as their biggest challenge.

Where Linnworks provides value is the ability to automate the sorting, organising and actioning of orders throughout the order lifecycle. Linnworks consolidates orders from various marketplaces into a single dashboard, automating workflows such as order routing, shipping label generation, and status updates, ensuring you provide an excellent customer experience for every single order and keep customers coming back.

“Linnworks supports bulk listing and editing, allowing retailers to push product data to multiple channels simultaneously while maintaining consistent and accurate listings. Additionally, automation rules can be set for tasks like repricing, inventory syncing, and custom order handling, helping to significantly reduce manual work and improve operational efficiency. These capabilities are especially valuable for furniture retailers dealing with high-SKU volumes, complex shipping logistics, and multi-channel demands,” commented Laura.

Supply chain optimisation

Selling furniture online presents logistical challenges due to the products’ bulkiness, weight, and fragility. Retailers must optimise their supply chains to manage shipping costs, inventory, and warehouse operations effectively without compromising on service.

“Linnworks helps furniture retailers navigate the complexities of shipping by providing tools that optimise costs, automate processes, and improve overall efficiency, especially when dealing with the unique challenges of large, bulky items and last-mile delivery,” commented Laura.

Shipping furniture can be costly due to the product’s weight and size, to such an extent that 67% of retailers cite high shipping costs as a major challenge. This issue is exacerbated by couriers being ill-equipped to handle and deliver such products.

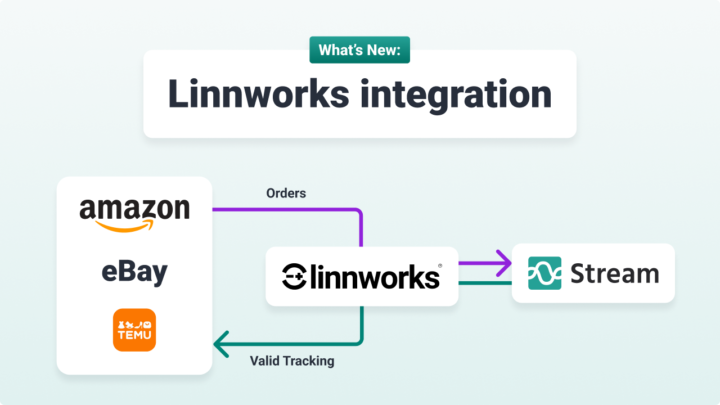

“If furniture retailers are delivering orders in their own fleet, Linnworks integration with Stream enables that process seamlessly,” says Laura. “Linnworks also integrates with multiple carriers, giving retailers the ability to compare shipping rates across different providers in real-time and choose the most cost-effective shipping options based on their specific requirements, including dimensional weight pricing, which is often a concern for large or bulky furniture items.”

With demand increasing for white-glove services, which includes unpacking, assembling, and fitting furniture as part of the last-mile customer experience. While these services enhance the customer experience even further, they incur additional costs, which retailers will look to offset elsewhere.

“By centralising order management across multiple sales channels, Linnworks ensures that retailers can automate and synchronise their fulfilment process, which reduces errors, delays, and unnecessary costs associated with manual order processing. This is especially useful for furniture retailers managing long lead times, as it ensures orders are processed promptly and efficiently,” continued Laura.

“Linnworks facilitates integration with third-party logistics (3PL) providers and local couriers for last-mile delivery. This means furniture retailers can select the best delivery options for their customers, whether that’s via a dedicated fleet, a regional courier, or a third-party service, improving delivery efficiency and providing better tracking visibility.”

International shipping

Cross-border shipping introduces complexities related to customs regulations, import/export tariffs, and currency fluctuations. 46% of retailers highlight these challenges as key barriers to trade. Dimensional weight pricing means it can often be expensive to export furniture such as sofas and dining sets.

The need for warehouse optimisation

Efficient warehouse organisation is crucial for handling furniture orders, which often involve multiple SKUs and batch-picking. Implementing a Warehouse Management System (WMS) and optimising warehouse layout can improve efficiency and reduce errors.

“With Linnworks, retailers can have a real-time view of stock levels across various locations. This helps optimise stock levels, avoid overstocking or stockouts, and plan shipments more effectively. By managing inventory more efficiently, furniture retailers can reduce the costs associated with expedited shipping and storage,” commented Laura.

Retailers looking to new product lines for growth

Many retailers are looking to launch new product lines as a key driver for growth in 2025. However, this requires a strategic approach to balance growth initiatives with operational efficiency.

The road ahead for online furniture retailers

Linnworks’ report alludes to an overall positive future for the online furniture market.

The impressive revenue figures and projected growth underscore a fundamental shift in the demand for online shopping for furniture.

However, as the report highlights, navigating ever-changing consumer expectations around delivery, sustainability, payment flexibility, and other demands is key to ensuring retailers remain competitive.

Through strategic diversification across multiple online marketplaces, coupled with focusing on supply chain optimisation, furniture retailers can further their market share and increasingly reach consumers online.

For more on the current state of e-commerce in 2025, read our ‘Navigating the Future of E-commerce: Key Strategies for Success‘ article. Or, discover the benefits of managing furniture wholesale & distribution in-house.

Running Linnworks and delivering goods and products in your own fleet?

Linnworks is fully integrated with Stream. Follow the link to learn more about the Linnworks integration.